Chatter: Basic Manual Project Management – Part 1: Cost Evaluation

Part of my part-time studies … don’t ask … included project management and two areas, which we take for granted when using the Microsoft Project tool are cost calculations and evaluations, as well as the application of PERT techniques. I personally found these topics interesting and will chat about then briefly in two separate posts … this being the first and embracing the cost calculations and evaluations.

The following table showing cash flow projections for two 5 year projects, will serve as example data for the duration of this blog post:

| Year | Project A | Project B | Project C |

| 0 | -100,000 | -2,000,000 | -1,000,000 |

| 1 | 20,000 | 400,000 | 400,000 |

| 2 | 20,000 | 400,000 | 400,000 |

| 3 | 20,000 | 400,000 | 100,000 |

| 4 | 10,000 | 400,000 | 100,000 |

| 5 | 70,000 | 100,000 | 10,000 |

Net Profit

Is the difference between the total cost and the total income of the project.

Looking at Project A, B and C we get:

- Project A: 20,000 + 20,000 + 20,000 + 10,000 + 70,000 – 100,000 = 40,000

- Project B: 400,000 + 400,000 + 400,000 + 400,000 + 100,000 – 2,000,000 = –300,000

- Project C: 400,000 + 400,000 + 100,000 + 100,000 + 10,000 – 1,000,000 = 10,000

- Therefore Project A and C are making a profit :) and Project B a loss :(

- Based on Net Profit, I would personally pick project A, because there is more money left over.

Payback Period

Defines the time it takes to break even and be able to payback the initial investment.

- Project B is looking grim as we have not broken even after 5 years.

- Project A looks a bit better, because after 4 years we have a cash flow of –30,000. With us making 70,000 in year 5, we will have broken even after 4.43 years.

- Project C looks slightly better, because after 4 years we have a zero balance … which is what all of us would love to see after a one million loan.

- Based on the payback period, I would personally pick project C as the payback period is the shortest. I would literally sleep better sooner …

Return of Investment (ROI)

Is also known as the accounting rate of return (APR) and in principal provides a way of comparing the net profitability to the investment required.

The calculation for ROI is the (average annual profit / investment) * 100. Hence …

- Project A = ((40,000/5)/100,000)*100 = 8%

- Project B = ((-300,000/5)/-2,000,000)*100 = –3%

- Project C = ((10,000/5)/1,000,000)*100= 0.2%

- Based on ROI, I would personally pick project A again as it has the highest ROI percentage.

Net Present Value

Is a project evaluation technique, that takes into account the profitability of a project and the timing of the cash flows produced.

- The present value is defined as = ( value in year X ) / ( 1 + discount rate ) to the power of the number of years into the future that the cash flow occurs.

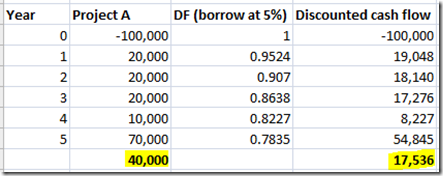

- To calculate the discount factor (DF in table below) we calculate as 1 / ( ( 1 + discount rate ) to the power of the number of years, whereby we are borrowing the investment at an interest of 5%, or a discount rate of 0.05.

- This one had me going for some time and we will select project A and call Excel for assistance:

- The Project A discounted cash flow looks worse than the net profit, but the good news (in my simple understanding of project management) is that we are still making a profit.

Hopefully when the project managers are chatting amongst each other, you will be able to catch and understand a few more fragments of their lingo and acronyms :) Next time we will chat about PERT techniques.