Flat Rate VAT in Office Accounting UK

Over the last couple of years I have been asked many times how one would handle flat rate VAT in Office Accounting, either from an end user standpoint or from an engineering standpoint. But before I begin, I will tell you flat out that I am not a big fan of the scheme, given how easy it is to keep VAT records in Office Accounting.

The way the government sees the Flat Rate VAT Scheme, it is easier if you don’t keep track of VAT on purchases and just record it on sales. Here is how it works:

- On the sales side, keep on adding 15% (formerly 17.5%) or 5% VAT as applicable.

- On the purchase side, you have to treat all purchases as zero rated, rather than using the regular VAT rate, thus adjusting the VAT code (and potentially the amounts) on every purchase. A regular purchase invoice may have net amount of £100.25 + 15% VAT = £115.29. This will have to be replaced with a zero rated purchase invoice of £115.29 + 0% VAT.

The tricky part here is that you have to remember to overwrite the VAT code and validate the unit price on every single line on each purchase invoice in order to get it right. If you forget, you may up overpaying for your purchases or you will have to adjust the amount at the end using a journal entry.

However the worst part is that you end up inflating the unit cost of your purchases, making the profitability of each item seem worse than it actually is.

A better way to use Flat rate in Office Accounting

It is much easier if you keep track of VAT on purchases and sales as you normally would. Here is how it works:

1. Keep VAT record as you normally would using the normal scheme by tracking VAT

2. Make adjustments on a journal entry

3. Create VAT return

The beauty of this method is that you use Office Accounting the same way you normally would, it doesn’t mess up your profitability and as an added benefit you can see if you have a gain or loss by using the flat rate scheme. How is that possible? Well, it is all in the adjusting journal entry.

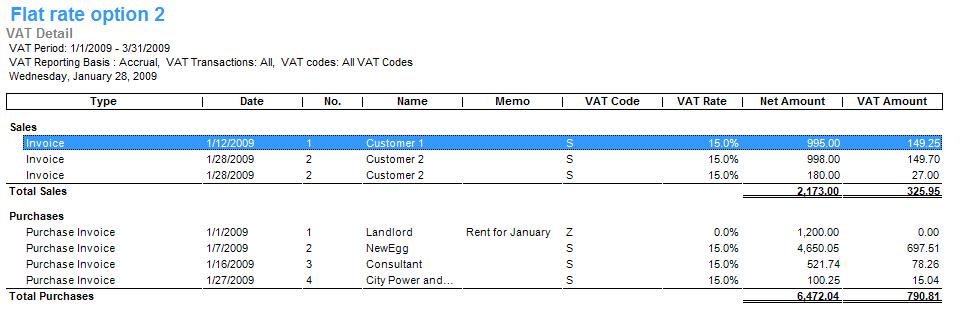

Let us look at some sample transactions without zero rating purchases.

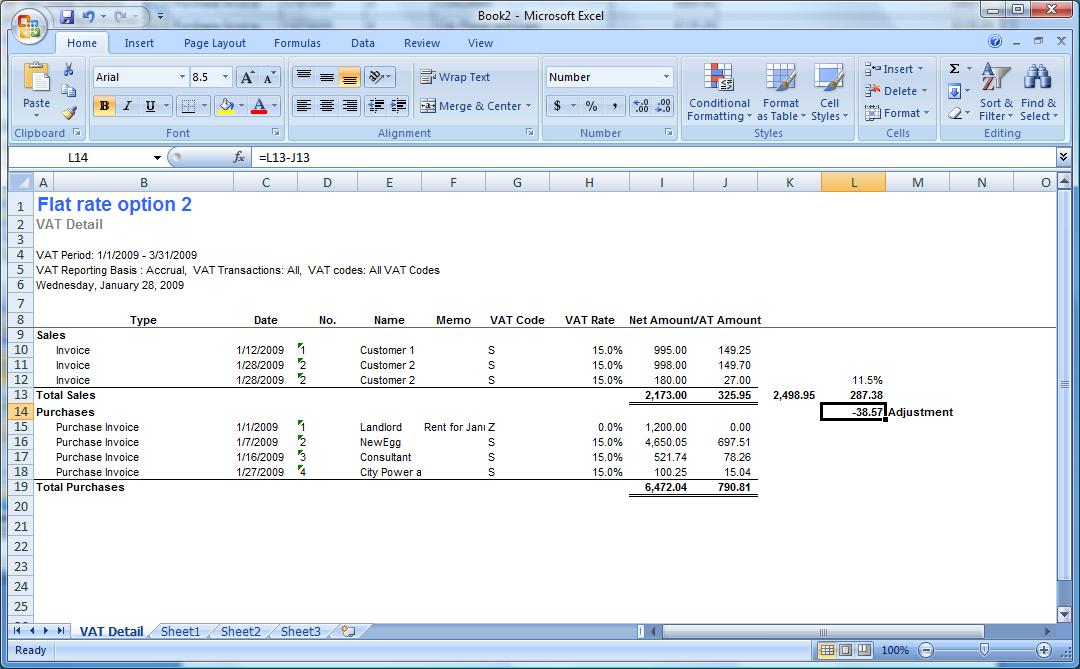

In order to figure out how much you owe in VAT using the flat rate scheme, I recommend you run the VAT detail report as depicted above and export it to Excel. Let us say that my business type is computer consultancy and the flat rate VAT is 11.5% as of December.

The VAT you owe is thus (£2173.00 + £329.95)*11.5% = £287.38 as seen above.

This means that you need to make an adjustment for the difference between the collected VAT amount and the owed amount (£325.95-£287.38 = £38.57) before you create your VAT return. If you adjust the amounts before creating the return, you and your accountant can keep track of what was actually filed to HMRC in Office Accounting (rather than just on paper).

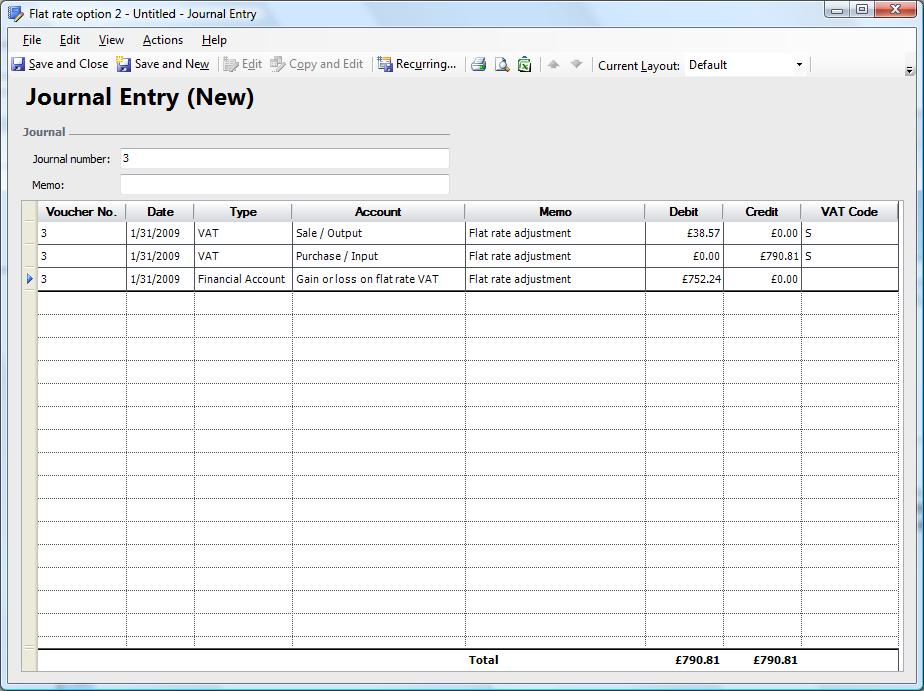

The resulting Journal Entry thus looks like this:

You debit the reduction in sales / output VAT as before, credit the full amount of purchase / input VAT and post the balance to an account to keep track of the gain or loss by using the flat rate VAT (I created an Other Income account for this purpose).

You may have noticed a loss (debit) of £752.24 on the scheme. The loss on flat rate VAT will be reduced as more of the stock is sold, but now it is simple to keep track of whether the flat rate scheme is in your interest (remember that the first year the government offers a 1% discount in flat rates, so if this was the first year in business, things would have looked slightly better).

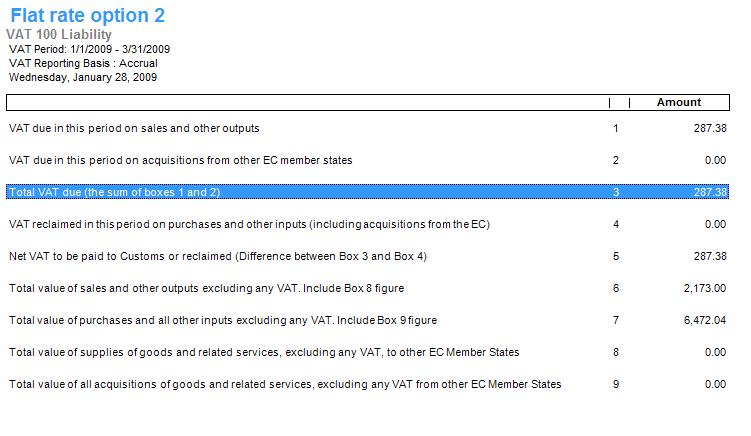

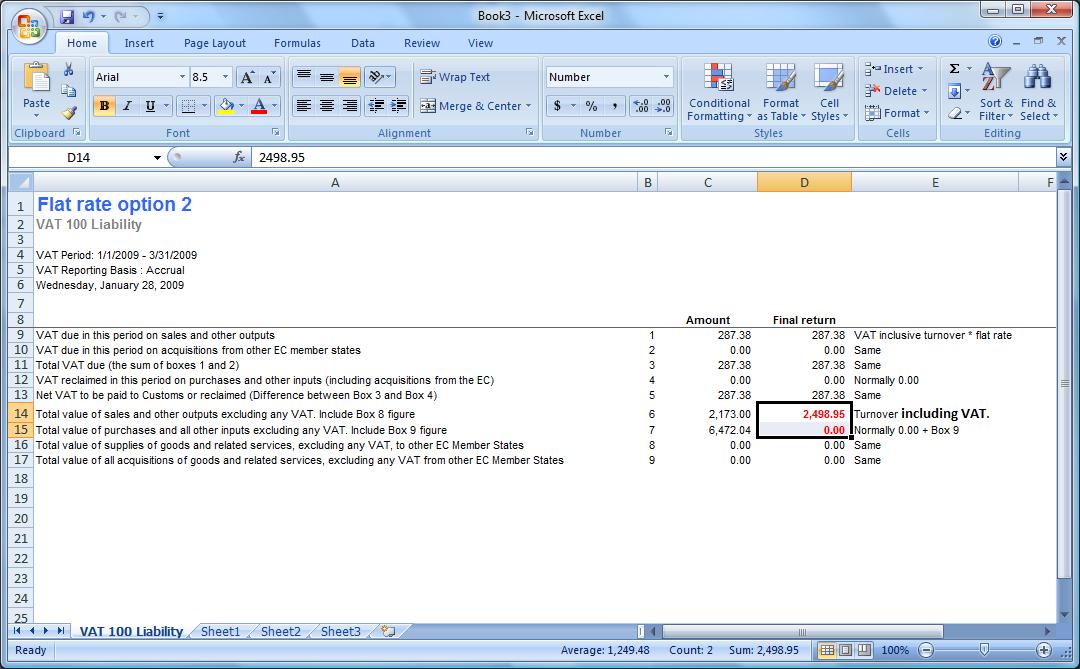

The resulting VAT 100 report looks as follows:

Now how should you fill out the return to HMRC? Again I recommend exporting to Excel.

Normally you will need to adjust box 6 and 7 in your filings (however you don’t have to make any more changes in Office Accounting).

When you can see you have the right result, go ahead and create the VAT return in Office Accounting and pay the amount to HMRC.