Payments Industrialization

A commonly asked question is if payments are a product or a commodity? I firmly believe the answer is that they are actual both. The traditional way of defining and processing payments has become very much commoditized. Facilitated by the homogenization of payment standards, particularly in Europe (and to a lesser extent in the North America), the back office area of a bank must process these transaction as quickly and cost effectively as possible. But banks also have a real opportunity to treat payment delivery and the customer service as a unique experience that builds customer loyalty and drives an innovative payment experience. This is clearly the product focus of payments and can be used effectively to drive deposit growth and revenue opportunities.

Payment Commoditization

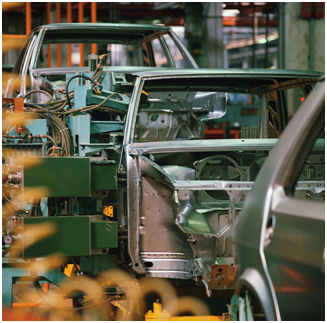

Today I’ll focus on the commoditization aspect. I’ve always thought it advantageous to look outside the walls of financial services to see how challenges and solutions for other industries could be applied in financial services. In recent reading I see that Enrico Camerinelli of Celent published a blog suggesting that bank profits are shifting from retail to wholesale banking – and interestingly draws a parallel line to car and truck-manufacturing industries. It’s a thought-provoking read that underlines the strategic importance of the back office areas of payments and core banking. Taking this a step further, what if banks looked at the vehicle manufacturing process as they plan legacy system renewal?

Since my schooldays in Britain I have always had a keen interest in cars and motorcycles. At one point I had the chance to visit a factory and I still remember seeing the various stages of vehicle assembly, with the final result being a car physically driven off the production line. Now Henry Ford didn’t invent cars, but he is the pioneer of the modern assembly line. He determined that efficiencies would be gained by concentrating activities in areas of expertise and managing the overall flow of vehicle assembly. The result was greater efficiency in the use of production resources and workers.

Since my schooldays in Britain I have always had a keen interest in cars and motorcycles. At one point I had the chance to visit a factory and I still remember seeing the various stages of vehicle assembly, with the final result being a car physically driven off the production line. Now Henry Ford didn’t invent cars, but he is the pioneer of the modern assembly line. He determined that efficiencies would be gained by concentrating activities in areas of expertise and managing the overall flow of vehicle assembly. The result was greater efficiency in the use of production resources and workers.

Payments Services FactorySo what does that have to do with banking? I mention this because it aligns well with an approach we call the Payments Services Factory. Regardless of whether a bank soldiers on with legacy systems or invests in a new payments hub, streamlining the transaction flow and gaining operation control is still an issue. The Payments Services Factory is an integration framework connecting multiple applications and technology platforms together. Think about payments as an orchestrated workflow of transaction data from customer to beneficiary. Along the way there are checks for compliance and various authorizations with ancillary systems. If you think about it, it’s really just like an assembly line.