Steps To Create a Core Diagram

To be fair, these are steps to create a solid understanding of the architecture of a business, but the deliverable is a core diagram, so that’s the title of the post. I first wrote about a method for creating core diagrams about a year ago, as I was preparing for a talk on the subject at the Open Group conference in San Francisco. Now that I’m preparing for another Open Group conference, I find myself filling out some of the details from the previous effort. Most of the text below is copied from an e-mail that I sent to a fellow business architect who was asking about how to create a core diagram.

The text below describes a five step process

- Collect a list of your organization’s business models

- Create or leverage a taxonomy of capabilities that reflect differentiation in business processes

- Differentiate each capability on the basis of Ross’ operating model taxonomy (level of Information Integration and level of Process standardization)

- Make an educated guess about the operating model of the company

- Draw the core diagram and build understanding around it

Understanding how to create a core diagram starts by collecting a list of the business models that your organization performs. Each business model is unique and different from the other ones. Each will require different capabilities and will often drive variations in those capabilities for the sake of market or product differentiation. You cannot create a core diagram effectively without the list of business models.

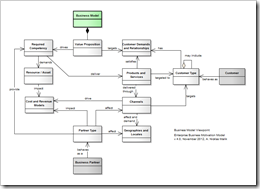

So what is in a business model? I’ve blogged about that fairly well. A business model is a composition of elements that describes how and why a value proposition exists, who it is for, and what it drives in terms of internal and external requirements. The diagram is below. (click to enlarge)

Once you have the initial list of business models, you will want to engage with direct business stakeholders. Make sure that they understand the concept of a business model, and what makes a business model unique from other business models (e.g. selling the same product in the same way to the same people in another country is NOT a unique business model, but selling a product in three different ways to three different, potentially overlapping market segments within one country probably represents three business models). Engage. Build relationships. This is your first shot.

Once you have that list fairly well baked, you have step two on your hands: a capability taxonomy that reflects process differentiation. In this case, it is a good idea to start with a high level process taxonomy like the ones made available for free from the APQC. I don’t know if there is one for financial services yet, but there should be. If not, you can start with a general one, but it will take some editing. You want your capability taxonomy to be worded in such a way that it represents “things that could be done” without reflecting the way in which they are done. For example, “customer identity management” is OK, but “customer deduplication” is not, because we want to make sure that customers have an appropriate identity but the organization may not want to remove duplication in order to do that.

This requires some editing of a large list of items in a hierarchy. Excel is OK for this. There may be other tools as well… I haven’t experimented past Excel. This is the second point where it is good to be engaging with business stakeholders. Get their help to describe their business model to you in terms of capabilities, and make sure that all of their capabilities are included in your taxonomy somewhere (usually around the third level down in the tree).

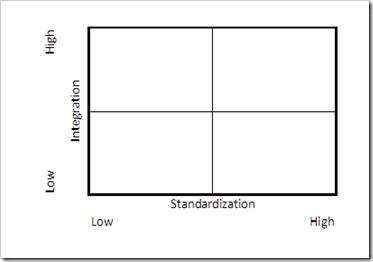

Step three is to differentiate each business capability on the dimensions suggested in the EA As Strategy book. (This can be done at a high level. If your taxonomy has more than 200 business capabilities in it, don’t use the most detailed level(s) of the taxonomy. No one has patience for the details in a core diagram.

Draw out a grid like the one illustrated in the EA As Strategy book, only make it empty.

In each one of the boxes, write in the capabilities that are well understood by a particular business stakeholder, then go to that stakeholder and validate your choices. Make sure that you have placed the correctly for that stakeholder’s particular business models. Note that very few stakeholders will have a valid opinion about capabilities that are NOT part of their particular business model, so don’t show capabilities that they don’t care about.

You will quickly discover that most folks agree on some things and disagree on some things. Where a single capability shows up in multiple businesses, one stakeholder may say that it needs high standardization, while another will say that the capability needs low standardization (== high flexibility). Take note of these disagreements. THEY ARE THE VALUE POINTS FOR BUSINESS ARCHITECTURE.

On everything you can get reasonable agreement on, go ahead and create a master table that has the capabilities differentiated in the manner above. That will probably be about 90-95% of your business capabilities in your taxonomy.

Step four is to make an “educated guess” about the operating model that your organization has. It’s a guess because most organizations are difficult to read and no one person will be able to answer your question about what the company as a whole looks like. Most of the time, you can start with the generalizations that Jeannie Ross made when describing the four operating models in her book “Enterprise Architecture As Strategy.” If there are a large number of capabilities in the “High Integration, High Standardization” box, you can suggest that your organization is a “Centralization” model. If, on the other hand, there are a large number in the “High Integration, Low Standardization” box, you can suggest that the organization is a Coordination model. This is the educated guess part because there is no good formula for making the guess. By this point, you will know a great deal about the organization so your guess is as good as your stakeholders.

Step five is to take a cut at your core diagram… Draw it out and then work with your stakeholders to get common understanding.

For each of the four styles of models, there are different styles of core diagrams. The centralization model tends to break out capabilities by functional area since there is very little (intentional) duplication. So it will be a diagram with a series of functional areas as boxes with the capabilities for each function listed in the boxes. Good idea to put the name of the person accountable for that business function in the title of the box. Lines between the boxes represent flows of information or value between them.

The Replication model is somewhat similar. There will be some functions that are owned by “corporate” while the rest are replicated into EACH of the operating units, so there will be two large “areas” on your diagram. The corporate area will have some functions with capabilities in them, and a single “replicated” area will have the remaining functions with capabilities in them. This is wildly valuable to business planners because they can get agreement among the leaders of each replicated unit about what each one of the is accountable to do and what they MUST depend on the corporate unit to do.

The collaboration model tends to be “hub and spoke” with the hub being the most integrated capabilities and the spokes being unique to each of the business models (or in some cases, small groups of business models that share a lot of capabilities). The lines tend to be information flow, not value flow. The capabilities in the spokes are usually duplicated between the different business units but they (should be) the capabilities that each business unit needs in order to differentiate itself or its products in the marketplace.

The diversification model is the most complex because the “corporate” unit tends to have a small number of core capabilities (often just financial ones) with each of the subsidiaries having a nearly complete and quite independent set of functions with massive duplication of capabilities across them.

I hope this gives you a good start in creating your core diagram.