How to Credit a Purchase Containing an Item Charge

The following blog post is to provide guidance for users of the Inventory costing functionality within Microsoft Dynamics NAV. The specific article is designed for providing guidance when a Purchase Return/Credit Memo is processed where the original Purchase includes Item Charge lines for freight or other additional costs. The information specifically identifies a best practice regarding the processing of an Item Charge line on a Purchase Credit Memo. In the discussion, guidance proves that the Item Charge should be applied against the original Purchase Receipt instead of applying the Item Charge to the Purchase Return/Credit Memo line for the Items being returned to correctly reverse the G/L Entries and all related costs for the Item Ledger Entries and Value Entries involved. A comparison of entries to the G/L are included for when the Purchase Return/Credit Memo Line for the Item Charge is applied to the original Purchase Receipt Item Ledger Entries verses if it is applied to the Purchase Return/Credit Memo line for the Items being returned. A full reversal of the original transaction at the G/L Entry level and Item Ledger Entry level will only occur if the Purchase Return/Credit Memo Item Charge line is correctly assigned to the original Purchase Receipt – not to the Purchase Return Line for the Item.

Scenario: How to Credit a Purchase Invoice with Item Charges

This scenario is carried out in W1 Cronus.

Default values are used if nothing else is stated.

1. Open Inventory Setup form (Warehouse -> Setup -> Inventory Setup) and set following:

- Automatic Cost Posting: Yes

- Automatic Cost Adjustment: Always

2. Create new Item (Purchase -> Planning -> Items)

- Description: Test Item Charges

- Base Unit of Measure: PCS

- Gen. Prod. Posting Group: RETAIL

- VAT Prod. Posting Group: VAT25

- Inventory Posting Group: RESALE

3. Create new Purchase Invoice (Purchase -> Order Processing -> Invoices)

- Buy-from Vendor No.: 10000

- Vendor Invoice No.: 123

with following lines:

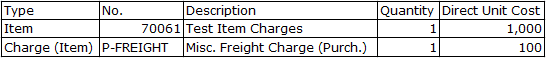

Purch.line:

4. Assign Item Charge to purchase line 1, item 70061 (On the Lines FastTab, click Actions -> Line -> Item Charge Assignment). Post the Invoice.

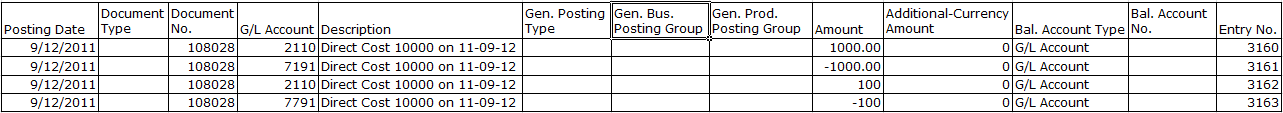

Created G/Lentries: Source code INVTPCOST

Created G/Lentries: Source code PURCHASES

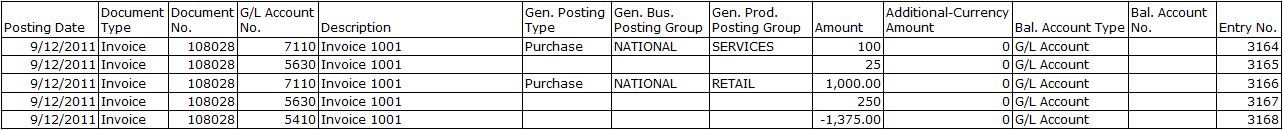

Status Item ledger entry and attached Value entries.

Assigning an item charge to an inbound entry makes the item charge to be a part of the acquisition cost. The amount of the freight fee is recorded in the Cost Amount (Actual) field in a separate Value entry representing the Item charge.

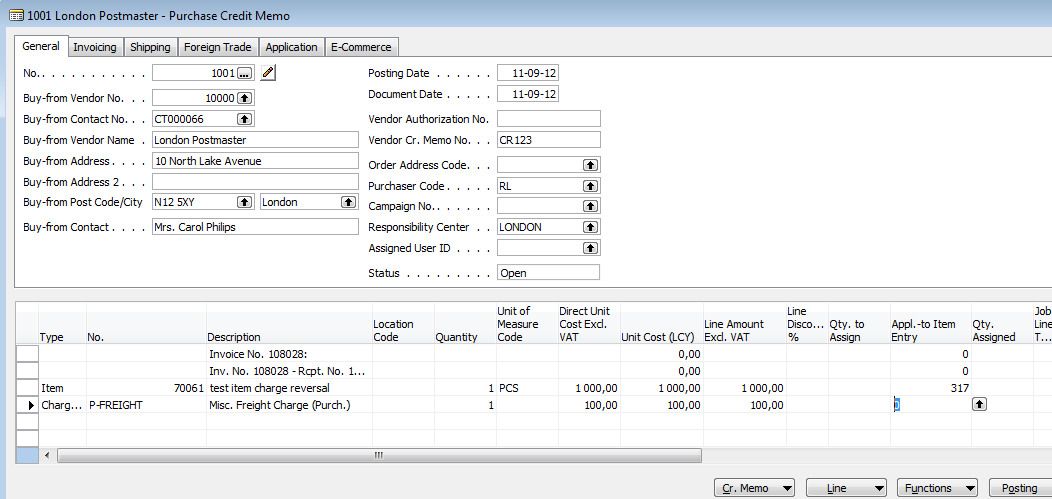

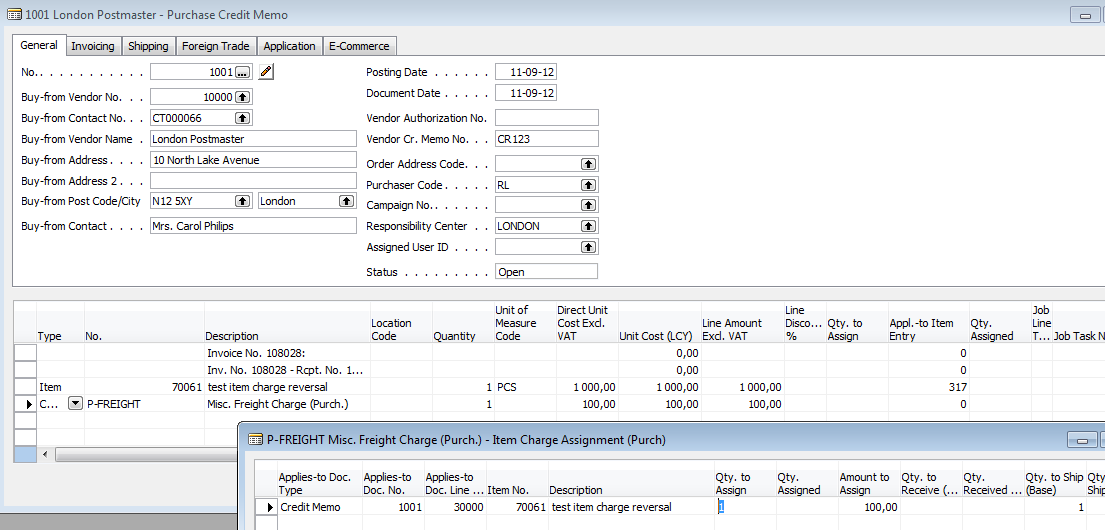

5. Create a new Credit Memo (Purchase -> Order Processing -> Purchase Credit Memos):

- Buy-from Vendor No.: 10000

- Vendor Cr. Memo No.: CR123

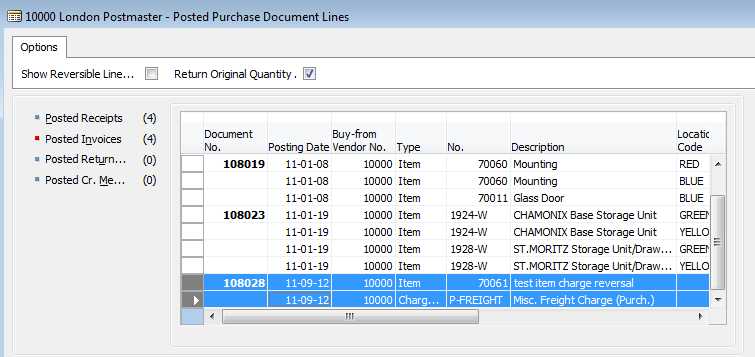

5. a) Click Actions, Functions, Get Posted Document Lines to Reverse, and choose lines from the invoice created in step 4.

The purchase credit memo is populated with the lines from the invoice, as below.

The Item line is automatically fixed applied to the original receipt, Item ledger entry 317.

5. b) Assign Charge(Item) (On the Lines FastTab, click Actions -> Line -> Item Charge Assignment).

The line from the Purchase Credit memo is suggested.

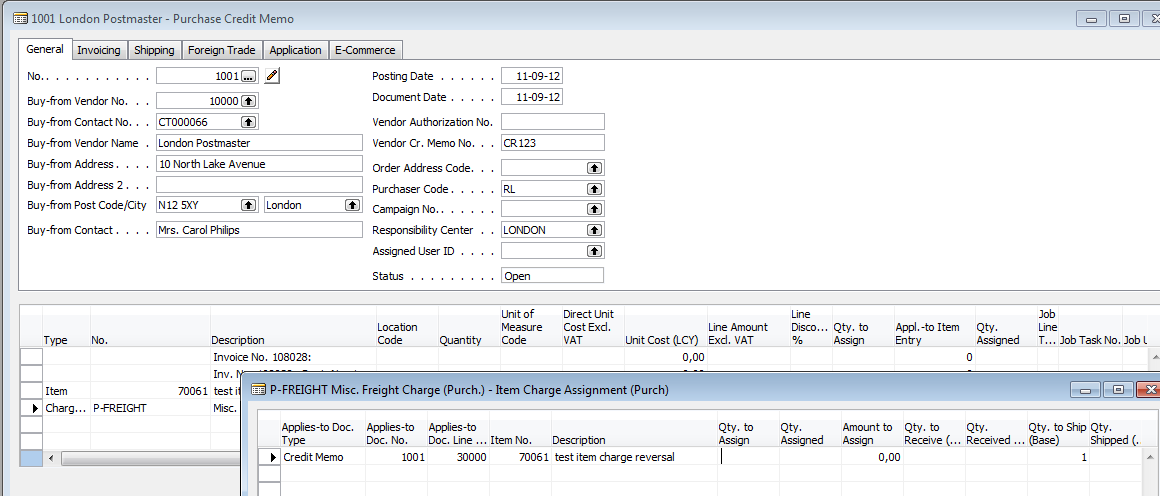

5. c) Delete the suggested line or keep it as it is but be thorough in the next step.

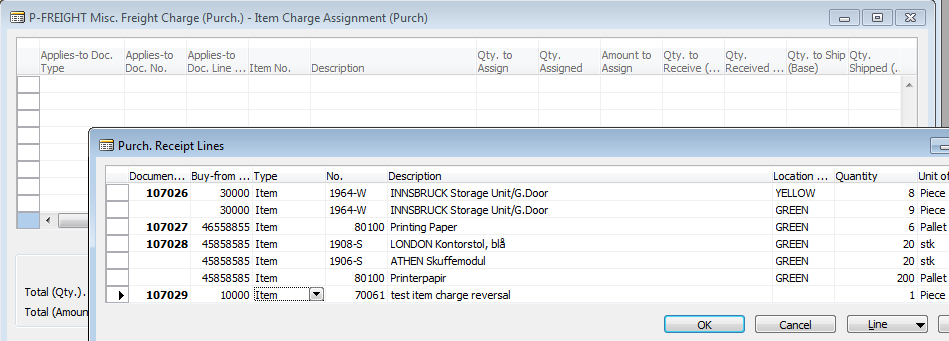

5. d) In the Item Charge Assignment form choose Functions -> Get Receipt lines.

Choose the Receipt line that represents the original receipt created by the Purchase invoice. This is actually the key if a purchase invoice with item charge is to be reversed and achieve a full reversal of earlier posting to the General Ledger.

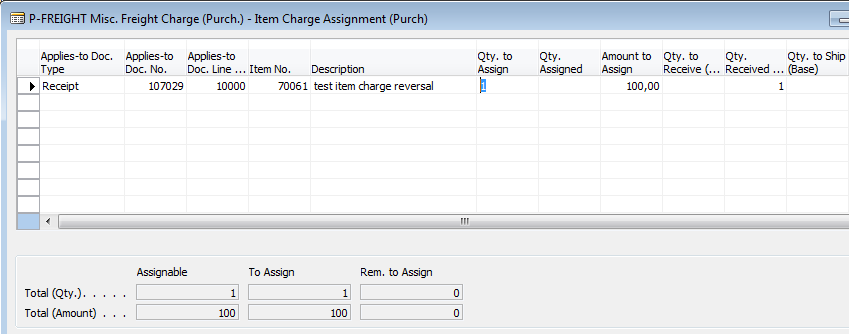

Assign the Quantity to the Receipt line as below. In this case the suggested line from the Credit memo was deleted. Note the Applies-to Doc Type at the left.

5. e) After having the Item charge assigned the Credit memo shall be Posted.

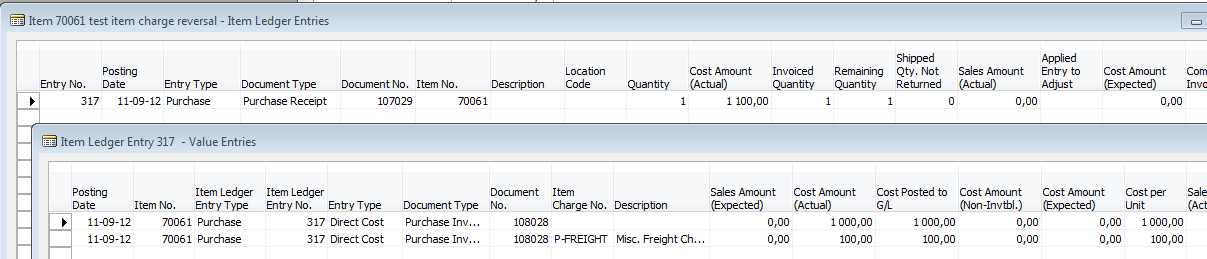

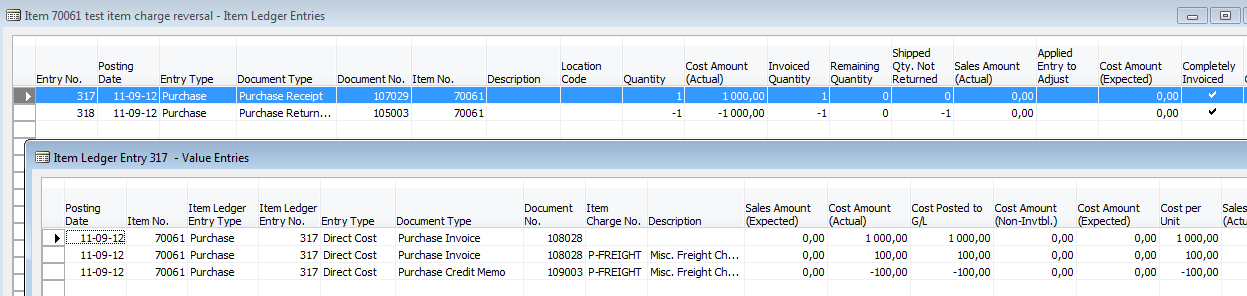

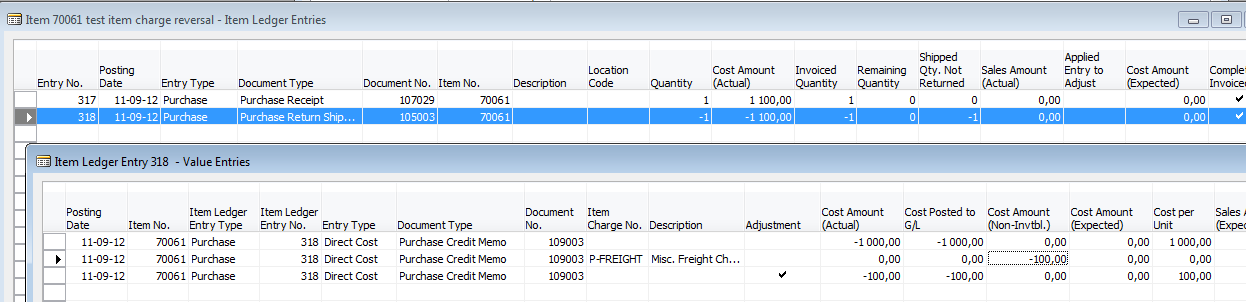

Status Item ledger entry of Original Purchase Receipt and attached Value entries:

The initial Item charges are now reversed, reversing the initial acquisition cost carried in field Cost Amount (Actual).

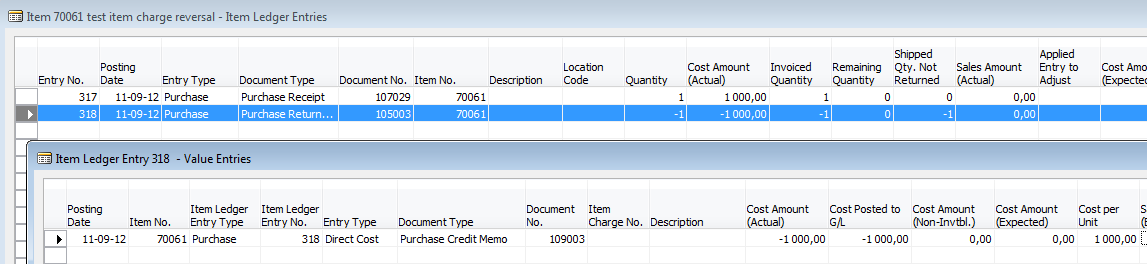

Status Item ledger entry of Purchase Return Shipment created by the Purchase Credit memo.

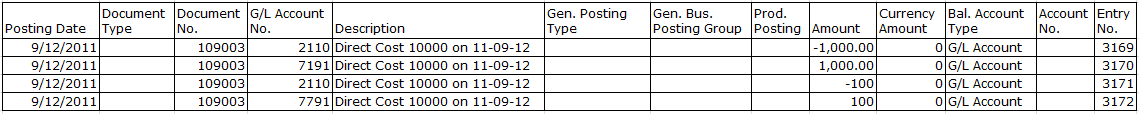

Created G/L entries: Source code INVTPCOST

Created G/L entries: Source code PURCHASES

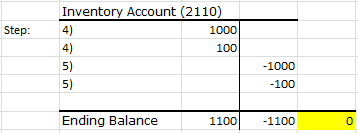

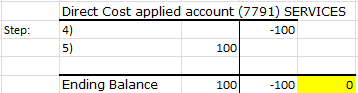

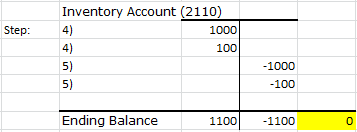

The respective G/L entries are also demonstrated in the T-accounts. Below is the T-account schema describing Postings to Inventory accounts + Purchase account. Accounts used as in W1 Cronus database. VAT, payables accounts are not described.

If the Item charge is assigned to the purchase credit memo line:

Using the same scenario and jumping directly into the Purchase Credit memo

5. d) The Item charge is assigned to suggested Credit memo line.

If the Item charge instead is assigned to the suggested Credit memo line. The item charge will be considered as a Non-inventoriable cost. The items that the item charge is assigned to are removed from inventory, the cost amount does not affect the inventory value.

The Credit memo is posted.

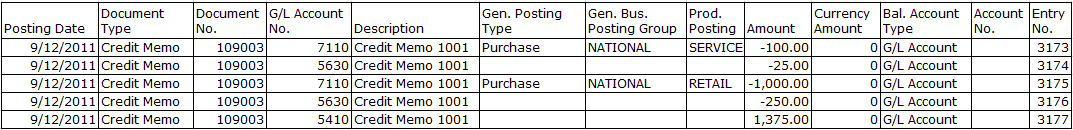

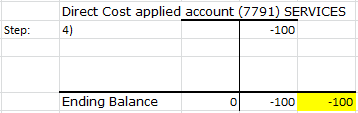

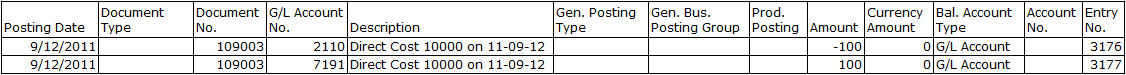

Created G/L entries: Source code INVTPCOST

Created G/L entries: Source code PURCHASES

Created G/L entries: Source code INVTPCOST

This G/L Register with Source code INVTPCOST is created by the Adjust cost item entries batch job that is running automatically in this scenario. The cost of the original Receipt is recognized to totally 1100 and therefore additonal 100 is forwarded to the Purchase Return. The additional cost follows the settings of the original item and do not differentiate or recognize the cost to be caused by an Item charge. Note the accounts the adjustment addresses versus what was recognized in the scenario above.

Status Item ledger entry of Purchase Return Shipment created by the Purchase Credit memo.

The respective G/L entries are also demonstrated in the T-accounts.