New Insurance Solutions Framework

There is a bit of movement here at Microsoft in the Financial Services space. In the insurance industry we just released the Insurance Value Chain. Before that launch I was working on interoperability scenarios with the ACORD standard and what that looks like in the WS-* world.

Now I'm happy to let you know we have more solutions for insurance companies out there. Based on the OBA RAP for Loan Origination concepts we have developed a set of solutions for the New Business Origination processes. The banking loan origination processes are very similar to the insurance new business processes, from an architecture perspective it makes sense to address this space with a similar architecture.

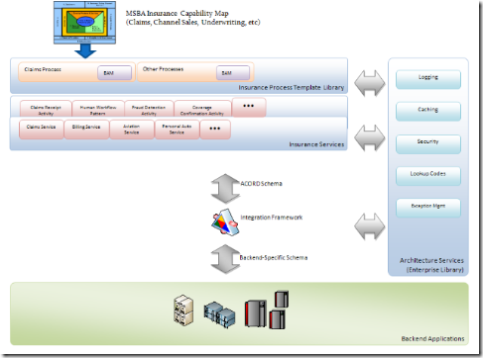

As shown above the Insurance Solution Framework (ISF) is built in a similar fashion as the OR-LOS solution providing the entire architecture picture. This architecture also fits in nicely with the Insurance Value Chain if you would like to plug in Commercial Off The Shelf (COTS) applications within the architecture.

The ISF supports the following Lines of Business (LOB):

- Life and Annuities

- Property and Casualty

- Life Care

The ISF abstracts the complexity of the underlying/backend systems, the unique OBA architectural approach and the framework enable businesses, overtime, to move from an application centric paradigm to a business process centric paradigm. Because the services, activities and process templates are built on ACORD a wide/broad range of backend systems can be surrounded/encapsulated to simplify the “topology” of applications. In cases where there are gaps in/between backend systems, the framework also provides a good design for building full-featured service.

This approach provides a viable alternative to rip-and-replace strategy typically required (due to additional capabilities required in backend systems like BAM, workflow, etc) to move to a business process centric paradigm. It leverages existing systems thus greatly reducing the risk associated core system replacement.

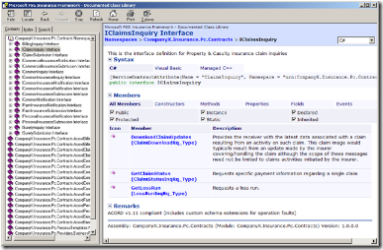

Not only is the architecture fully defined but it is also well documented. Implemented in a similar style as many of our SDK's ISF provides an enormous amount of definition around the architecture as well.

As all of you know the insurance business process is extremely complex and varies depending on which insurance carrier your at. The ISF is more of a solution accelerator or a reference architecture rather than a line of business solution. Keep that in mind we you investigate these solutions.

If you would like more information on the Insurance Solutions Framework contact Microsoft Consulting Services. I will work with MCS to possibly write some whitepapers that will give you more guidance into our thoughts in the insurance space.