The Microsoft Lending Message Bus

The lending message bus (LMB) provides messaging services for the lending processes. This made sense to since there are many touch points in the process. Both internally and externally there are points that need management and consolidation.

The LMB follows Enterprise Service Bus (ESB) practices it can also integrate well with in the enterprise ecosystem. Either augmenting or apart of the centralized ESB.

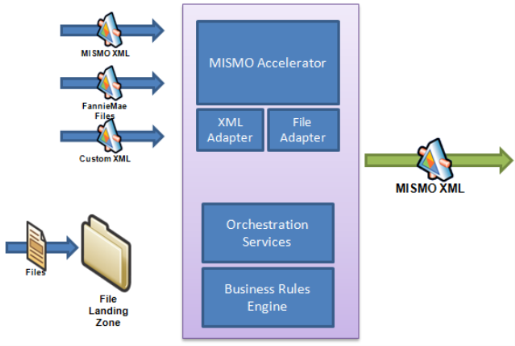

Below you will see a logical model of the components of the lending message bus and dependencies. The OR-LOS solution currently only takes MISMO XML. This is not to say that you can't add other inputs.

As shown by the logical architecture, XML Web Services (WS) or flat files are sent to the LMB. From here they are consumed by the MISMO accelerator hosted within BizTalk. The data is transformed and routed to the appropriate destination based on the business rules and orchestrations. What this means is that instead of hand coding message routing in C# messages are managed centrally in BizTalk abstracted out at a system level instead of the application. This loose coupling between messaging and the application opens the door for interoperability with other systems that may be the same or other business processes.

It is important to note that this is a logical representation of the message bus and not a physical. These message bus can be deployed within a tiered DMZ for external communications as well.

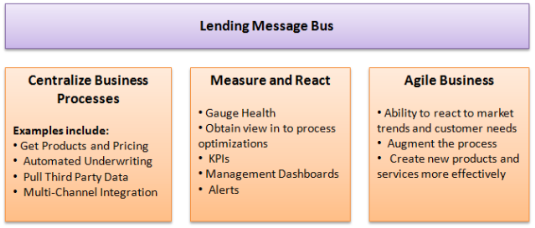

You are probably asking, well that's great from a technical perspective but what about from a business perspective? From a business perspective this is important to any bank that has a multi-channel integration strategy. The overall OR-LOS lending framework lends to this, but the LMB really enables us here. With the LMB it serves as a platform that can unite lending channels through common processes and information.

When we look at the larger issue of breaking down silos with other channels that are outside of lending the arena the LMB again facilities this through both technology and industry standards. Since the architecture encourage the use of XML web services and industry standards such as MISMO interoperating with commercial off the shelf (COTS) and homegrown or custom developed systems are easier. There is still a lot of heavy lifting left however.

The governance aspects can be facilitated by technology but you have to actually implement and govern the technology that enables the process. The point I am making is that this technology is not unique, but rather the implementation of it is best practice for accomplishing this goal.

As shown above the LMB has several benefits to the business. I break it down to 3 core business capabilities. As shown above there are direct benefits to the business.

I leave you with this... BREAK DOWN THOSE LOB SILOS!!!

Photo by TomasSoukup