Week 5: Do you know? Series of the Week

Weekly, the Dynamics GP team will be posting a ‘Did you know?’ series. We’ll give tips, tricks, and general comments around features and functions that already exist in Microsoft Dynamics GP. This week we will focus on Payroll Garnishments.

Our challenge to you is…how much do you really know about Dynamics GP?

In the past, we would frequently be excluded from various payroll software proposals because of Microsoft Dynamics GP’s lack of payroll garnishment functionality. Well, that all changed with the release of Microsoft Dynamics GP 10.0. Check it out!

Why this feature is cool!

This feature adds functionality to match increasingly complex payroll responsibilities. Court-ordered garnishments may require deductions from an employee’s wages for child support, medical support, unpaid taxes, or debts. Federal and state law regulates multiple aspects of each garnishment, including the types and amounts of wages subject to garnishment, the method of calculating the garnishment, and the priority of each garnishment relative to other deductions. This feature allows users to meet these regulations, by enabling them to:

· Base garnishment deductions on either a Percentage of Gross Income, a Percentage of Net Income, a Percentage of Earnings (Net Disposable Income), or a Fixed Amount

· Specify which pay codes, deduction codes, and tax codes to include in the calculation of Net Disposable Income

· Set up Federal and/or State maximum withholding and exemption amounts

· Capture court order information, such as Court Name and Court Date of the Garnishment Deduction

What does it look like?

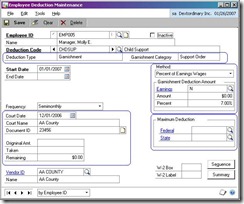

In the Employee Deduction Maintenance window, the user sets up a garnishment deduction for an employee.

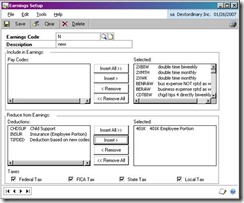

In the Earnings Setup window, the user specifies which pay codes, deduction codes, and tax codes to include in the definition of an earnings (Net Disposable Income) code, which is subject to garnishment deduction.

Thanks,

Ben C.