Accounting for Purchase charge and Stock variation

Dear readers,

The SCM-costing team is happy to announce that an update for the “Post to charge” accounting principle is finally ready.

The update includes a significant change in the ledger accounting logic consumed by the “Post to charge” accounting principle. This change might require that customers reconfigure their posting profiles in order to get the correct accounting entries in the general ledger.

Configuration

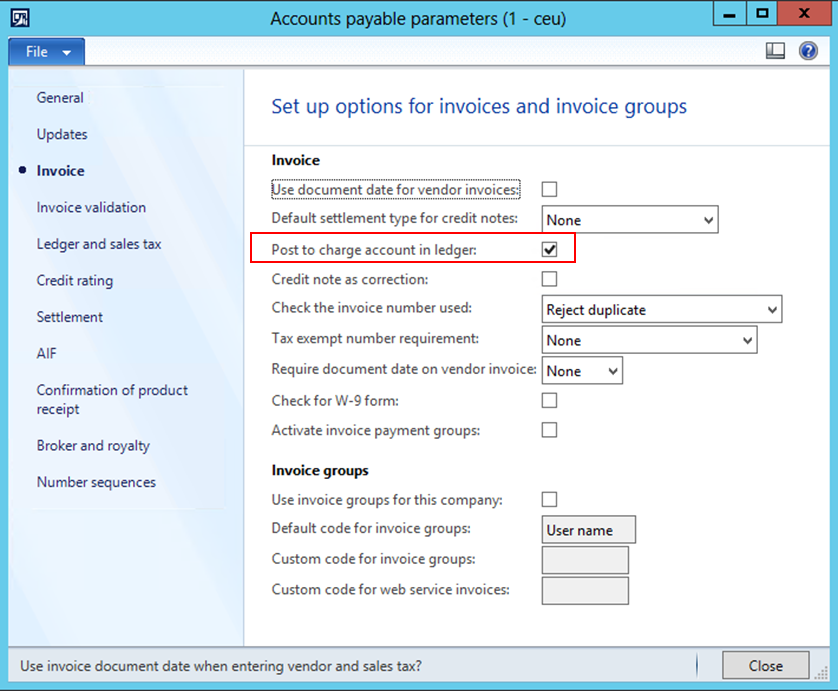

The “Post to charge” accounting principle is still enabled through parameter configuration.

Path: Accounts payable > Setup > Accounts payable parameters

We recommend the following parameter settings for accounting of inventories. Applying these recommended settings will make reconciliation to General ledger much simpler at the end of the fiscal period.

|

Module/form |

Parameter |

Recommended setting |

|

Inventory management/Item model group |

Post physical inventory |

Yes |

|

Inventory management/Item model group |

Post financial inventory |

Yes |

|

Inventory management/Item model group |

Accrue liability on product receipt |

Yes |

|

Accounts payable/Accounts payable parameters |

Post product receipt in ledger |

Yes |

|

Procurement and sourcing/Procurement and sourcing parameters |

Generate charges on product receipt |

Yes |

|

Accounts receivable/Accounts receivable parameters |

Post packing slip in ledger |

Yes |

|

Production control/Production control parameters |

Post picking list in ledger |

Yes |

|

Production control/Production control parameters |

Post reports as finished in ledger |

Yes |

Note: The “Post to charge” accounting principle now has a dependency on the Post product receipt in ledger parameter. The system will validate the current settings and warn customers in case of a conflicting configuration.

Accounting for material

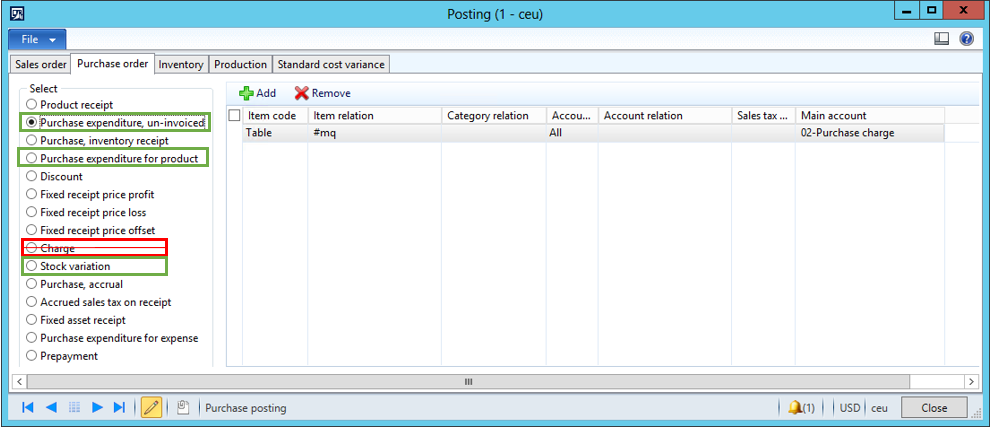

The “Post to charge” accounting principle originally used two designated posting types:

- Charge

- Stock variation

The new accounting logic will make the Charge posting type obsolete.

Instead, the Purchase expenditure, un-invoiced and Purchase expenditure for product posting types should be used for accounting charges of the Material type in General ledger.

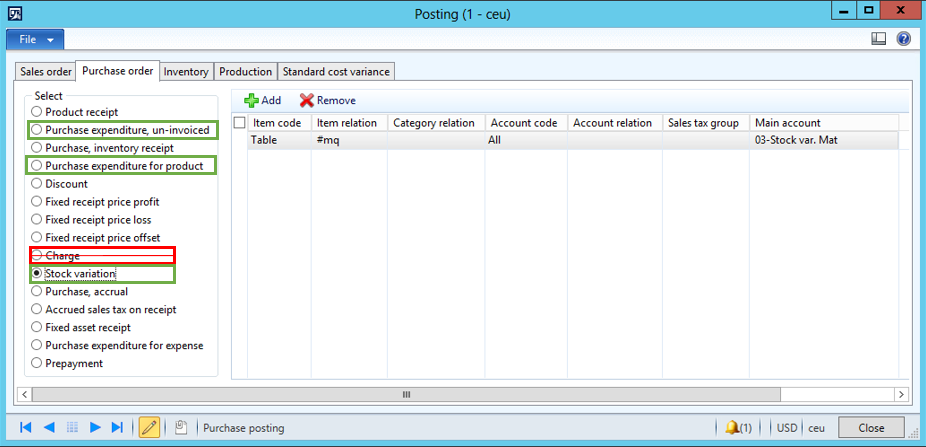

The Stock variation posting type will act as stock variation for direct material cost.

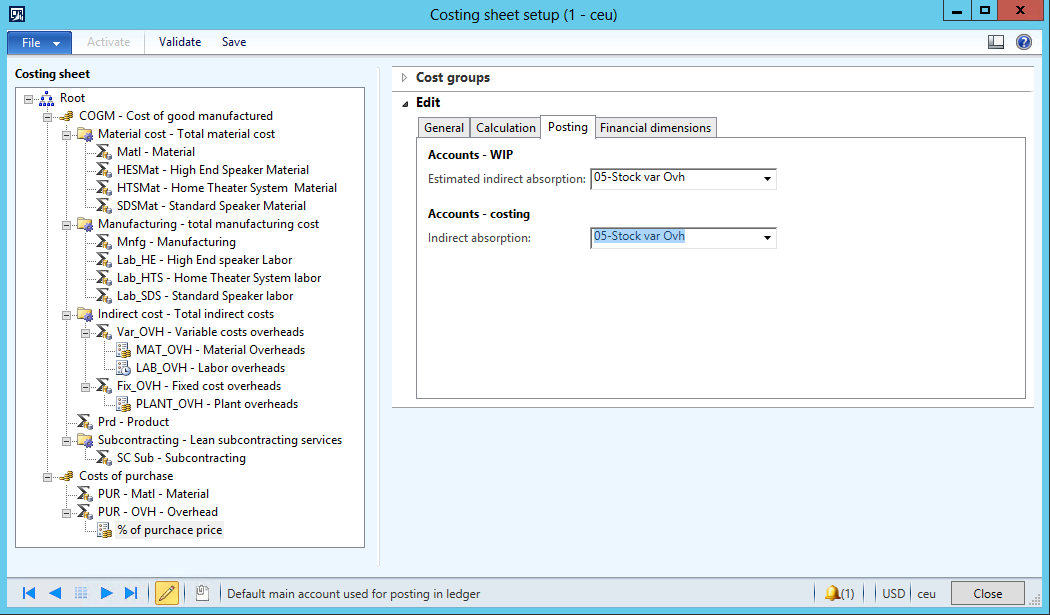

Accounting for purchase overhead

The Estimated indirect absorption and Indirect absorption posting types will now act as stock variation for overhead cost.

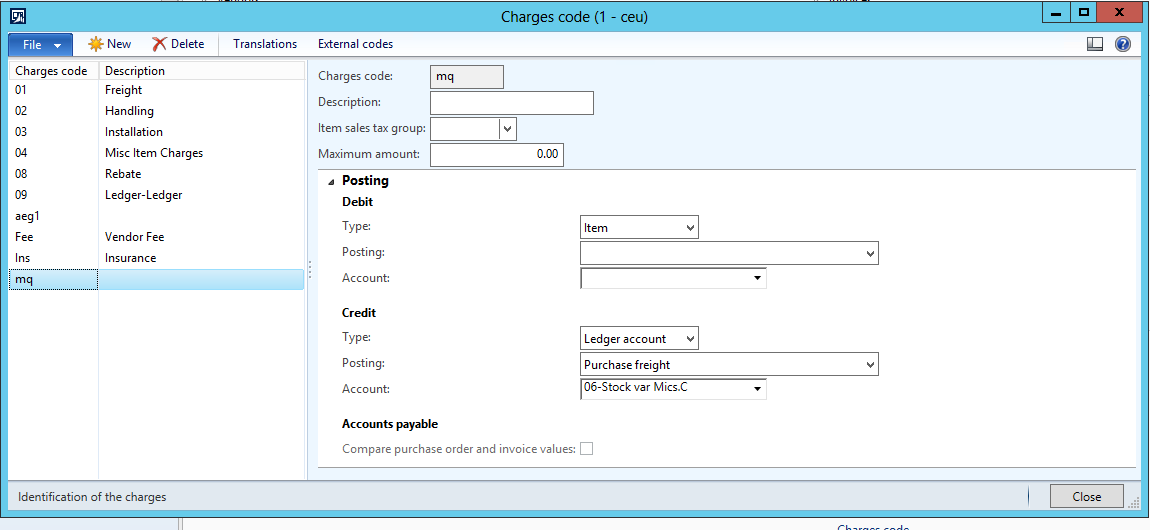

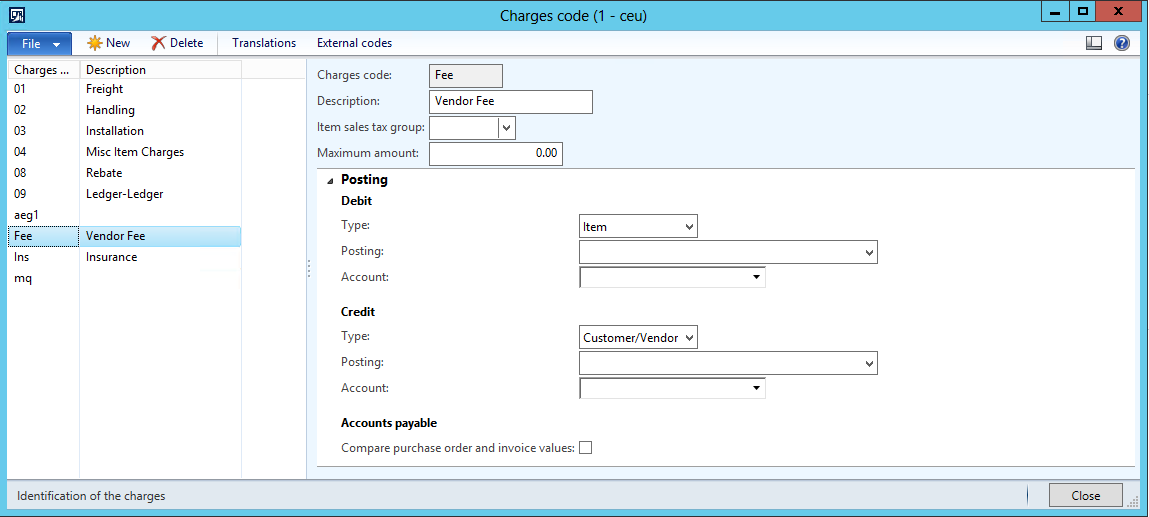

Accounting for Miscellaneous charges

The patch for “Post to charge” has intentionally been delivered after the release of the “Post Misc. charges on product receipt” feature. You can read more about this feature in this blog post: http://blogs.msdn.com/b/dynamicsaxscm/archive/2014/11/11/post-misc-charges-at-time-of-product-receipt.aspx

The reason for the delayed release was that miscellaneous charges that are accounted for at the time of product receipt are now correctly treated by the posting logic of the “Post to charge” accounting principle.

Miscellaneous charges on a purchase order can affect the valuation of inventory assets under two configurations:

- Debit item – Credit Ledger account

- Debit item – Credit Customer/Vendor

In the case of Debit item – Credit Ledger account, the ledger account selected as the absorption account now acts as a stock variation account.

In the case of Debit item – Credit Customer/Vendor, the miscellaneous charges will be accounted as material cost, and the stock variation account of the item will be used.

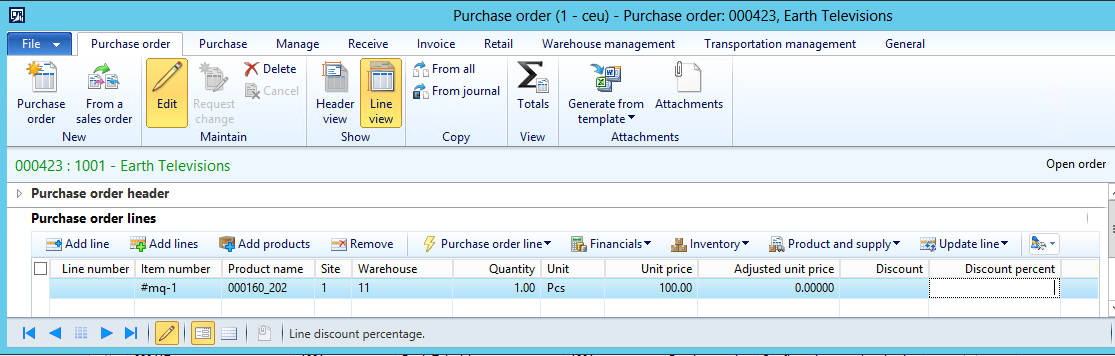

Example 1

Prerequisites for this example:

- Item: #mq-1

- Valuation method: FIFO

- A purchase order of 1 piece is created. A unit cost of 100.00 is agreed on.

- Confirm the PO.

- Post the product receipt.

-

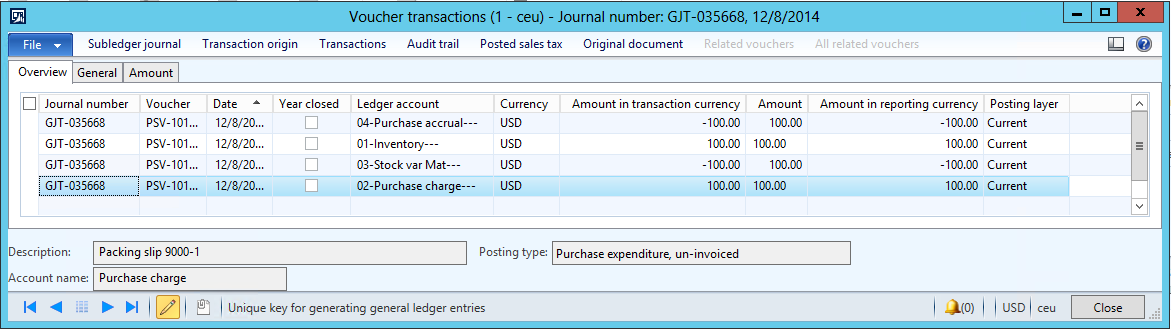

Validate the posting of the product receipt.

Validating the ledger accounting entries in the voucher

|

Account |

Name |

Posting type |

Amount |

|

03-Stock var Mat |

Stock variation-Material |

Purchase, stock variation |

-100.00 |

|

01-Inventory |

Inventory |

Product receipt |

100.00 |

|

02-Purchase charge |

Purchase charges |

Purchase expenditure, un-invoiced |

100.00 |

|

04-Purchase accrual |

Purchase Accrual |

Purchase, accrual |

-100.00 |

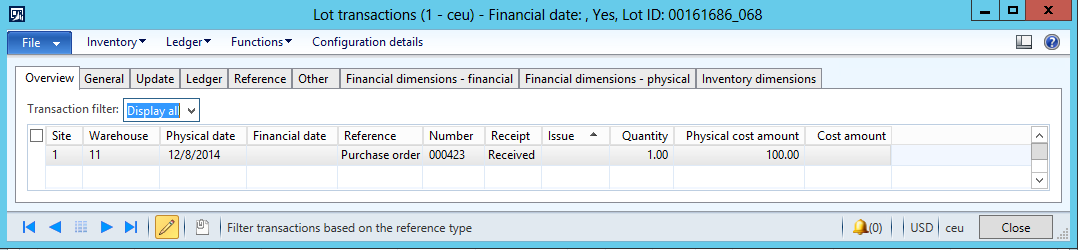

Validating the physical cost amount on the inventory transaction

-

Post the invoice, and validate the postings.

The unit price has changed since the product receipt was posted. The unit price is now 110.00

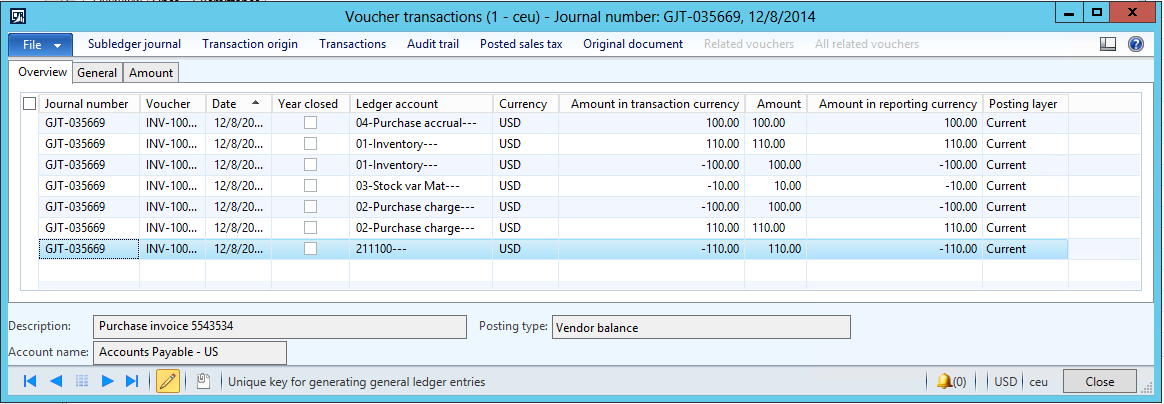

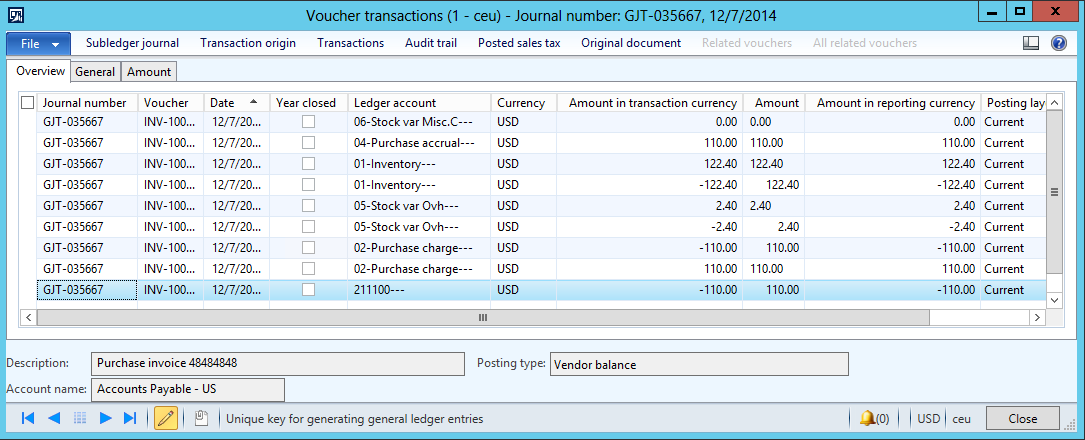

Voucher of the invoice

|

Account |

Name |

Posting type |

Amount |

|

03-Stock var Mat |

Stock variation-Material |

Purchase, stock variation |

-10.00 |

|

01-Inventory |

Inventory |

Product receipt |

-100.00 |

|

01-Inventory |

Inventory |

Purchase, Inventory receipt |

110.00 |

|

02-Purchase charge |

Purchase charges |

Purchase expenditure, un-invoiced |

-100.00 |

|

02-Purchase charge |

Purchase charges |

Purchase expenditure for product |

110.00 |

|

04-Purchase accrual |

Purchase Accrual |

Purchase, accrual |

100.00 |

|

211100 |

Accounts Payable – US |

Vendor balance |

-110.00 |

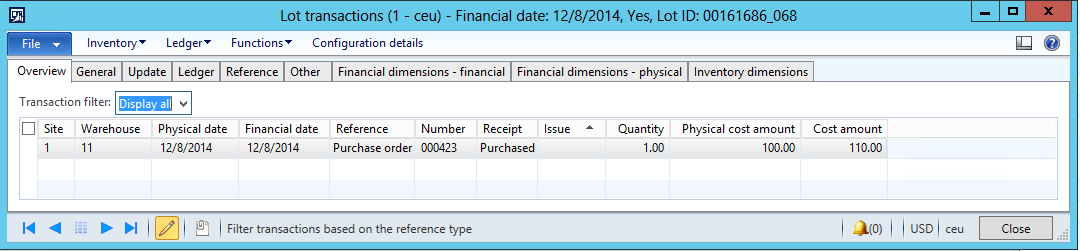

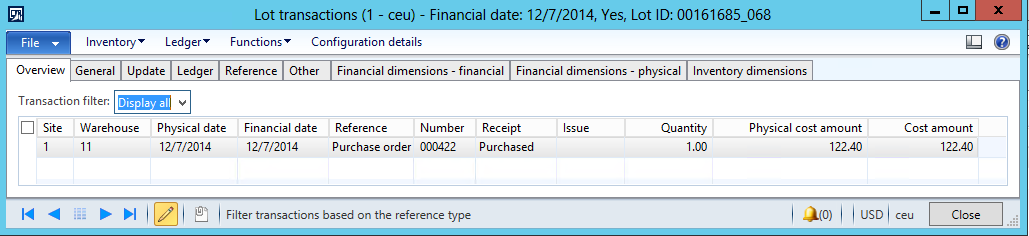

Validating the financial cost amount on the inventory transaction

Example 2

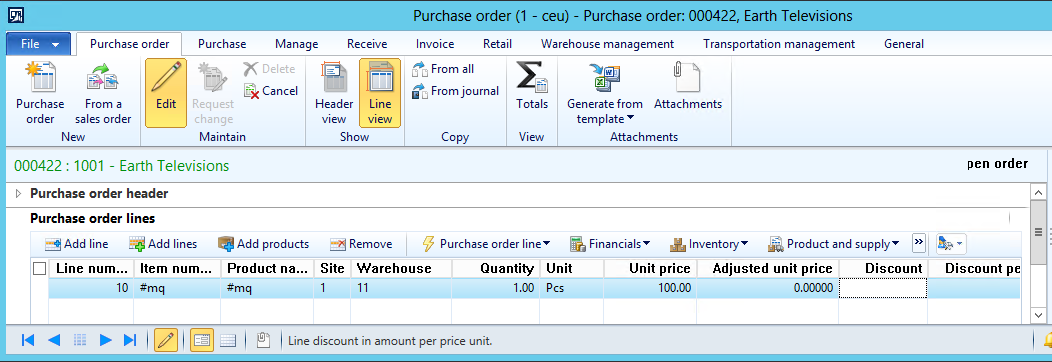

Prerequisites for this example:

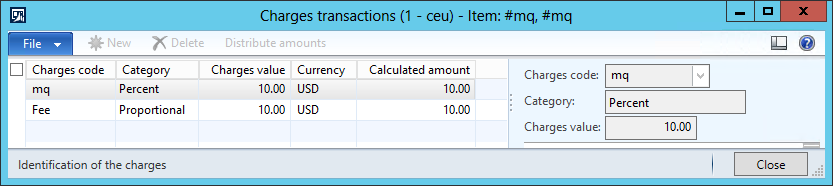

- Item: #mq

- Valuation method: FIFO

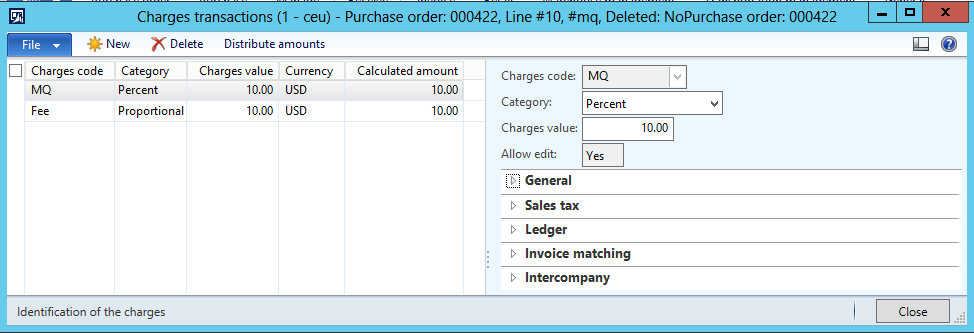

- Misc. charge 1: Debit item – Credit Ledger account 10.00%

- Misc. charge 2: Debit item – Credit Customer/Vendor 10.00 Proportional

- Indirect cost: 2.00% on top of purchase price

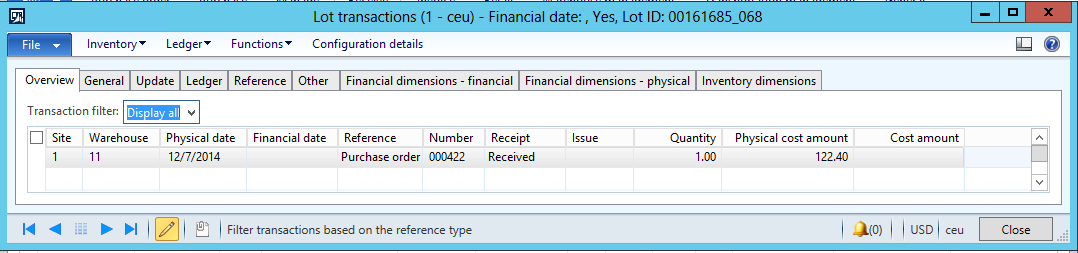

- A purchase order of 1 piece is created. A unit cost of 100.00 is agreed on.

- Assign the miscellaneous charges codes, and allocate them to the lines.

- Confirm the PO.

- Post the product receipt.

-

Validate the posting of the product receipt

Validating the miscellaneous charges amount calculated and accounted on the product receipt

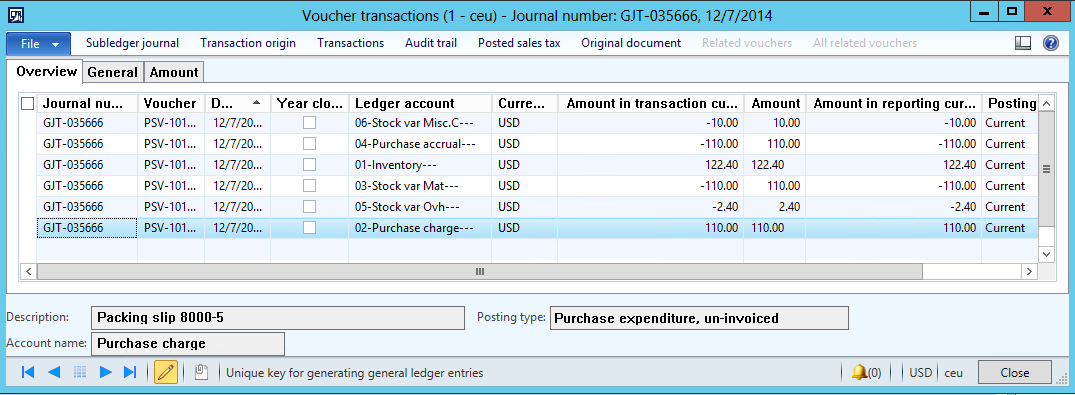

Validating the ledger accounting entries in the voucher

|

Account |

Name |

Posting type |

Amount |

|

03-Stock var Mat |

Stock variation-Material |

Purchase, stock variation |

-110.00 |

|

05-Stock var Ovh |

Stock variation-Overhead |

Estimated indirect absorption |

-2.40 |

|

06-Stock var Misc.C |

Stock variation-Misc. charges |

Purchase freight |

-10.00 |

|

01-Inventory |

Inventory |

Product receipt |

122.40 |

|

02-Purchase charge |

Purchase charges |

Purchase expenditure, un-invoiced |

110.00 |

|

04-Purchase accrual |

Purchase Accrual |

Purchase, accrual |

-110.00 |

Validating the physical cost amount on the inventory transaction

-

Post the invoice, and validate the postings.

For the sake of simplicity, there is no change in unit price in this example, and no additional miscellaneous charges are added.

Voucher of the invoice

|

Account |

Name |

Posting type |

Amount |

|

06-Stock var Misc.C |

Stock variation-Misc. charges |

Purchase freight |

0.00 |

|

05-Stock var Ovh |

Stock variation-Overhead |

Estimated indirect absorption |

2.40 |

|

05-Stock var Ovh |

Stock variation-Overhead |

Indirect absorption |

-2.40 |

|

01-Inventory |

Inventory |

Product receipt |

-122.40 |

|

01-Inventory |

Inventory |

Purchase, Inventory receipt |

122.40 |

|

02-Purchase charge |

Purchase charges |

Purchase expenditure, un-invoiced |

-110.00 |

|

02-Purchase charge |

Purchase charges |

Purchase expenditure for product |

110.00 |

|

04-Purchase accrual |

Purchase Accrual |

Purchase, accrual |

110.00 |

|

211100 |

Accounts Payable – US |

Vendor balance |

-110.00 |

Validating the financial cost amount on the inventory transaction

Released versions

The feature will be made available for following releases of Microsoft Dynamics AX:

- Microsoft Dynamics AX 2012 R3

- Microsoft Dynamics AX 2012 R2 (This will be available at a later time.)