Post Misc. charges at time of Product receipt

Dear readers

The SCM-costing team in collaboration with SCM-Procurement team are happy to introduce a capability requested by customers for many years.

We introduce the capability of accounting for Misc. charges already at time of posting Product receipt.

This capability will provide customers with the opportunity to better estimate cost of purchase and avoid cost fluctuations at time of Invoice.

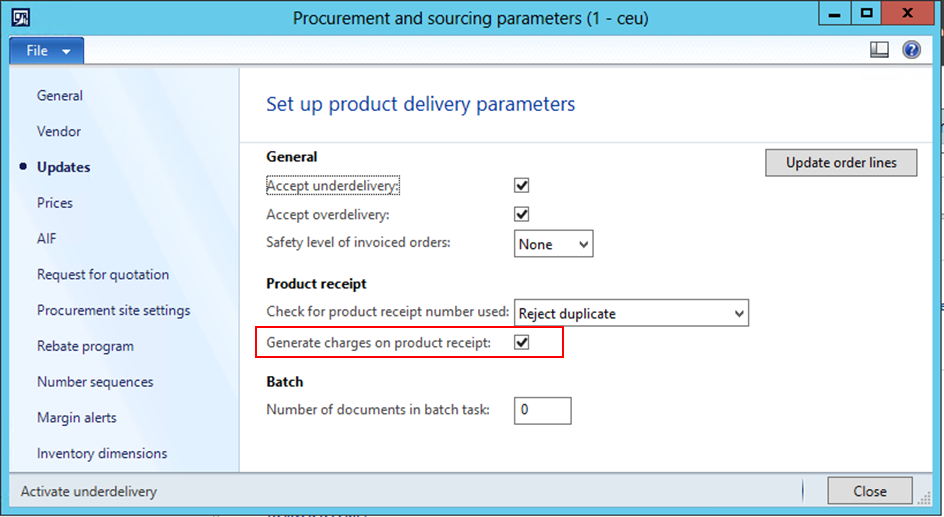

Configuration:

As this capability directly impact valuation of inventory assets and thus can be considered a change in accounting principle the feature will be controlled by a new parameter.

Path: Procurement and sourcing/Setup/Procurement and sourcing parameters

Note: In next major release of Microsoft Dynamics AX this capability will not have its own parameter but will be controlled by the Accrue liability on product receipt parameter on the Item model group.

We recommend the following parameter settings for accounting of inventories. Applying these recommended settings will make reconciliation to General ledger much simpler at end of fiscal period.

| Module/Form | Parameter | Recommended setting |

| Inventory Management/Item model group | Post physical inventory | Yes |

| Inventory Management/Item model group | Post financial inventory | Yes |

| Inventory Management/Item model group | Accrue liability on product reciept | Yes |

| Accounts payable/Accounts payable parameters | Post product reciept in ledger | Yes |

| Procurement and sourcing/Procurement and sourcing parameters | Generate charges on product reciept | Yes |

| Accounts receivable/Accounts receivable parameters | Post packing slip in ledger | Yes |

| Production control/Production control parameters | Post picking list in ledger | Yes |

| Production control/Production control parameters | Post reports as finished in ledger | Yes |

Note: If you want to account for Misc. charges at time of posting product receipt and has checked marked “Generate charges on product receipt” you must as minimum also check mark “Post physical inventory” and “Post product reciept in ledger”

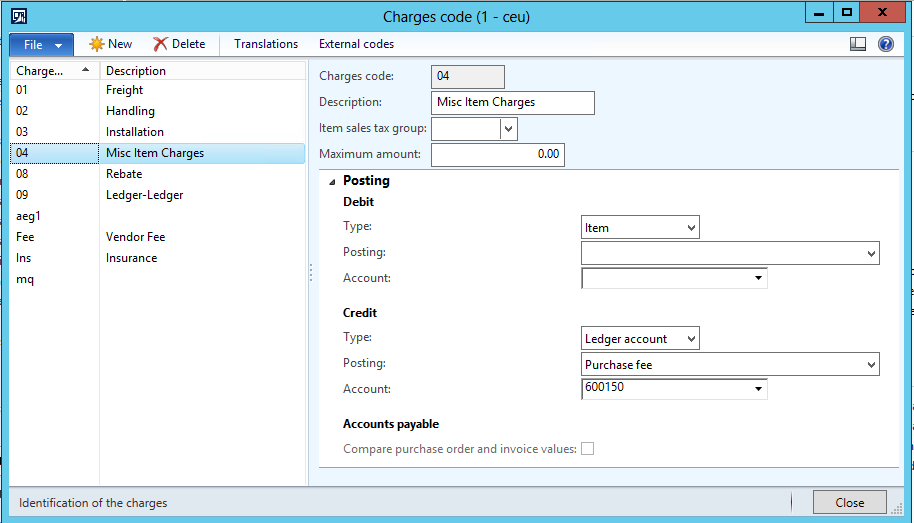

Defining Misc. charges:

Before the Misc. charge will be accounted at time of posting product reciept it has to fulfil certain requirements.

Misc. charge code:

The Misc. charge code has to be configured so it will be accounted as Inventory asset.

In Fast tab Posting under field group Debit the Type has to be Item. The Credit type can be either Ledger or Vendor.

Misc. charge calculation categories:

Not all Misc. charge calculation categories will post at time of Product reciept. The table below list the Misc. charge calculation categories applicable and how the value is calculated.

|

Misc. charge calculation category |

Applicable charge value on product receipt line |

Applied amount |

| Pcs | As per purchase order line applicable charge value | Received Quantity * Pcs value rate |

| Percent | As per purchase order line applicable charge value | Receipt net amount * % value |

| Proportional * | (Purchase order line applicable charge value / ordered quantity) * Received quantity | (Received quantity / Ordered quantity) * “PO line proportional Value” |

*Proportional: A new Misc. charge calculation categories delivered as part of the feature

Note: Misc. charge calculation category = Fixed. No cost will be accounted for at time of posting Product reciept. The cost will still be accounted for at time of Invoice.

Note: Sales tax on Misc. charges will not be posted at time of product reciept.

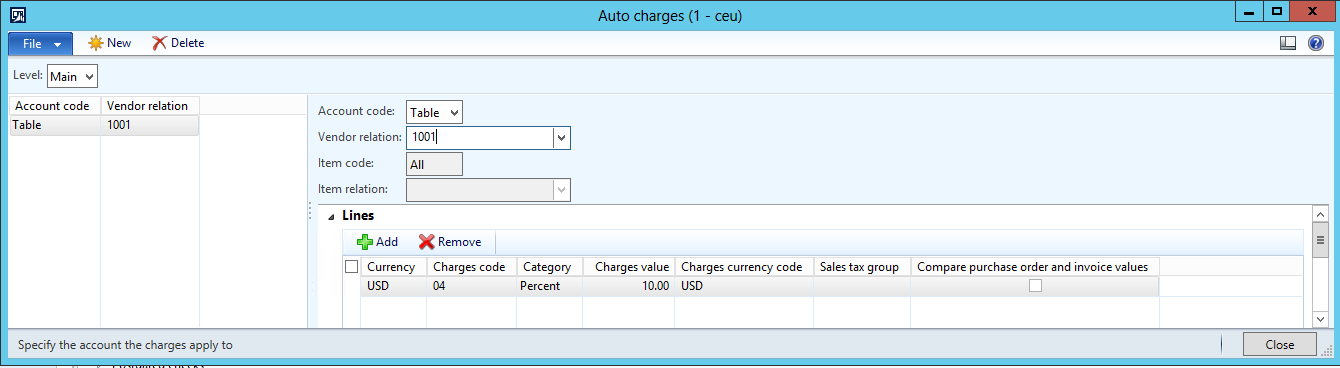

Auto charges:

Auto charges will now be applied on time of Product receipt if records correspond to the rules defined above.

Example:

Prerequisite for the example:

Item: Misc. charge D1

Valuation method: Moving average

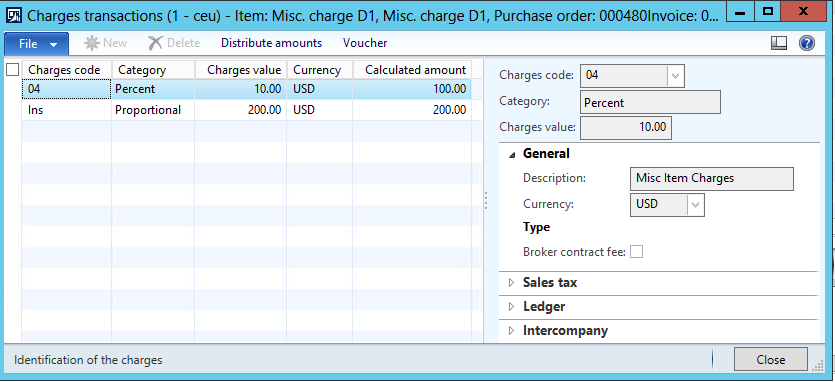

Auto charge: 10.00 Category = Percent

Misc. Charge: 200.00 Category = Proportional

Indirect cost: 1.00 % on purchased price + Misc. charge cost

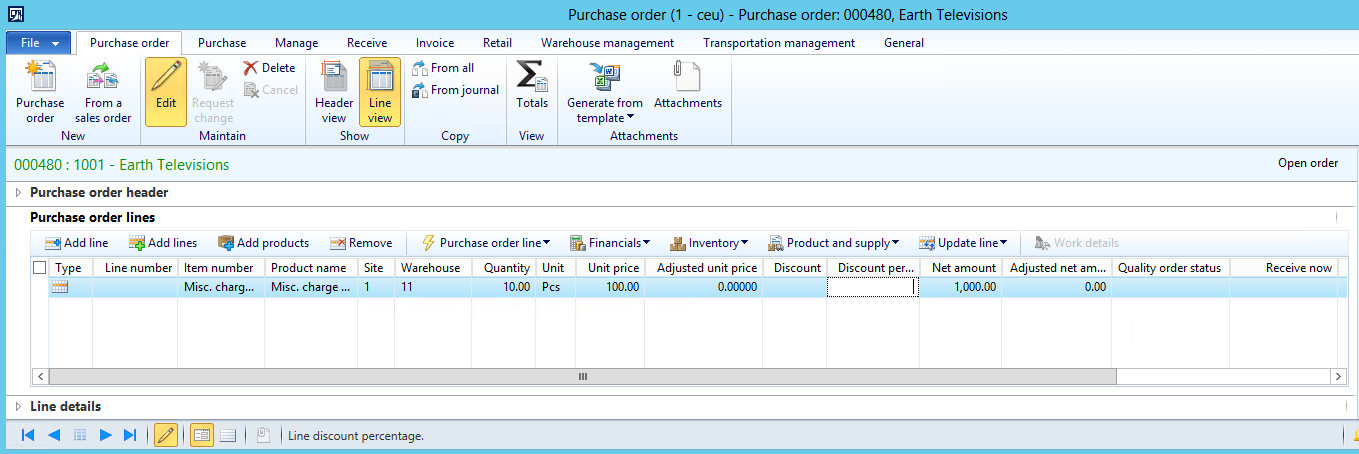

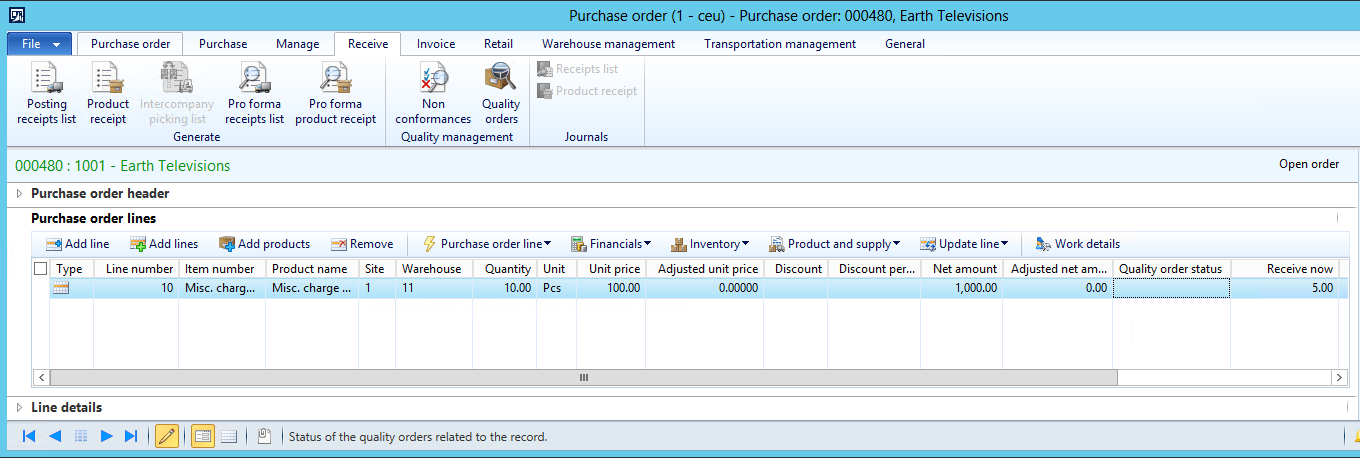

1. A purchase order of 10 pcs. is created. The unit cost is agreed at 100.00

2. Adding Misc. charge manually

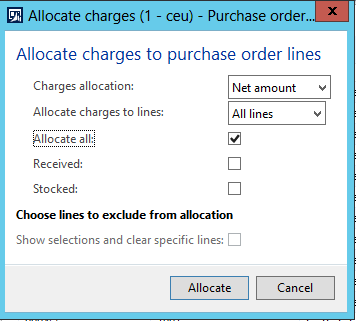

3. Allocate the Misc. charges

4. Confirm PO

5. Post Product reciept.

- Because of insufficient stock at the supplier a

partial delivery of 5 pcs will be received

- Select “Receive now quantity” in field Quantity

Press button Charge: The user can validate the Misc. charges calculated by the system for the specific Product reciept prior posting.

Line net amount = 5 * 100.00 = 500.00

Charge code 04: 500.00 * 10% = 50.00

Charge code INS: 5/10 * 200.00 = 100.00

Press OK to post Product receipt

6. Validating posting of Product reciept

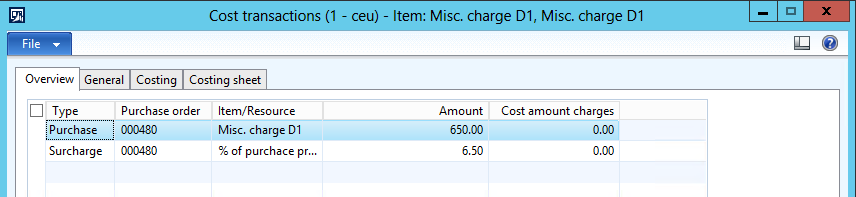

Purchase cost transactions

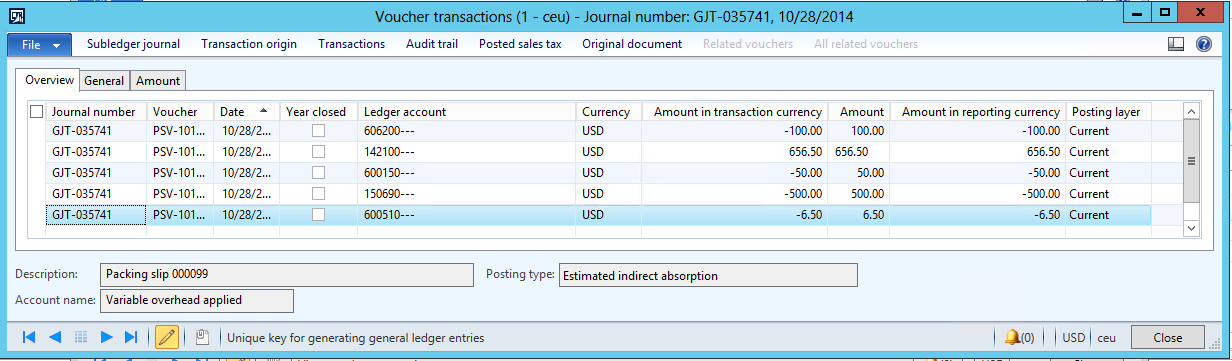

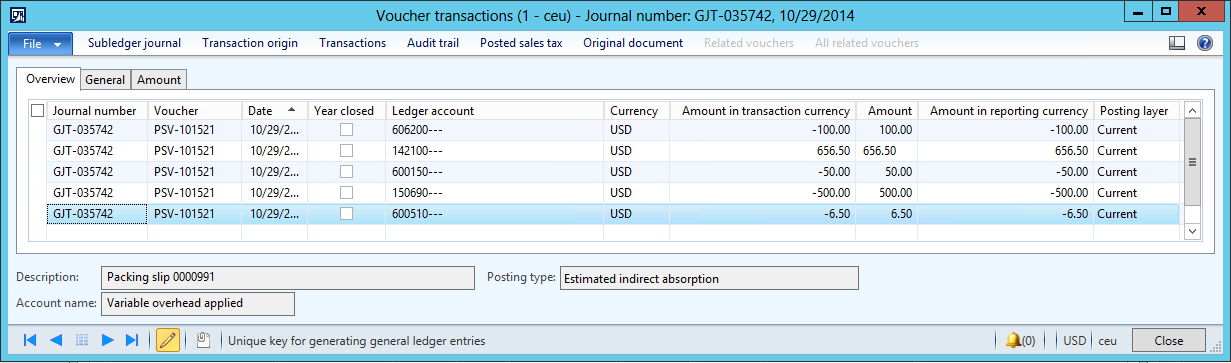

Validating the voucher

|

Account |

Name |

Calculation |

Direction |

Amount |

|

600510 |

Indirect cost absorption |

650 *1% |

Credit |

6.50 |

|

142100 |

Inventory |

500.00 + 100.00 + 6.50 |

Debit |

656.50 |

|

150690 |

Purchase accrual |

5*100.00 |

Credit |

500.00 |

|

600150 |

Auto Misc. charge absorption |

500.00 * 10% |

Credit |

50.00 |

|

606200 |

Misc. charge absorption |

(5/10) * 200.00 |

Credit |

100.00 |

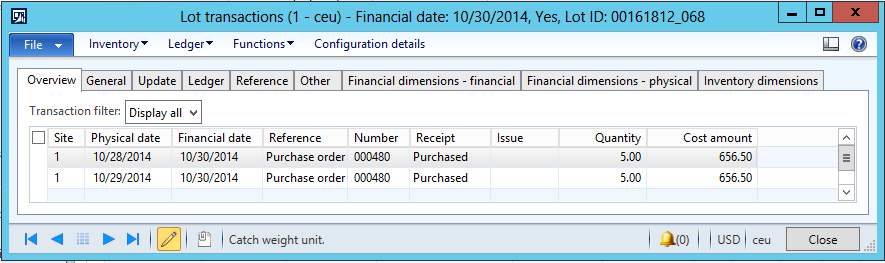

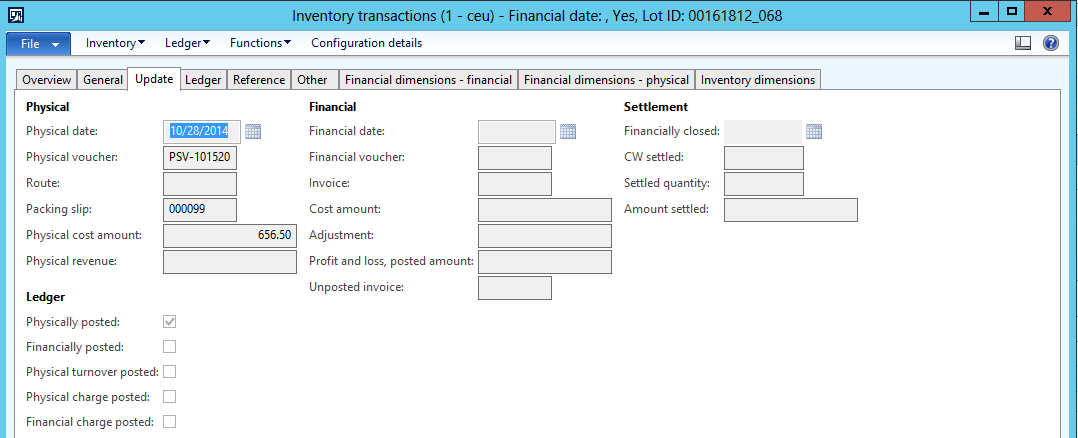

Validating the physical cost amount on Inventory transaction

7. Post a Product reciept of the remaining 5 pcs.

- The postings are identical with the above

|

Account |

Name |

Calculation |

Direction |

Amount |

|

600510 |

Indirect cost absorption |

650 *1% |

Credit |

6.50 |

|

142100 |

Inventory |

500.00 + 100.00 + 6.50 |

Debit |

656.50 |

|

150690 |

Purchase accrual |

5*100.00 |

Credit |

500.00 |

|

600150 |

Auto Misc. charge absorption |

500.00 * 10% |

Credit |

50.00 |

|

606200 |

Misc. charge absorption |

(5/10) * 200.00 |

Credit |

100.00 |

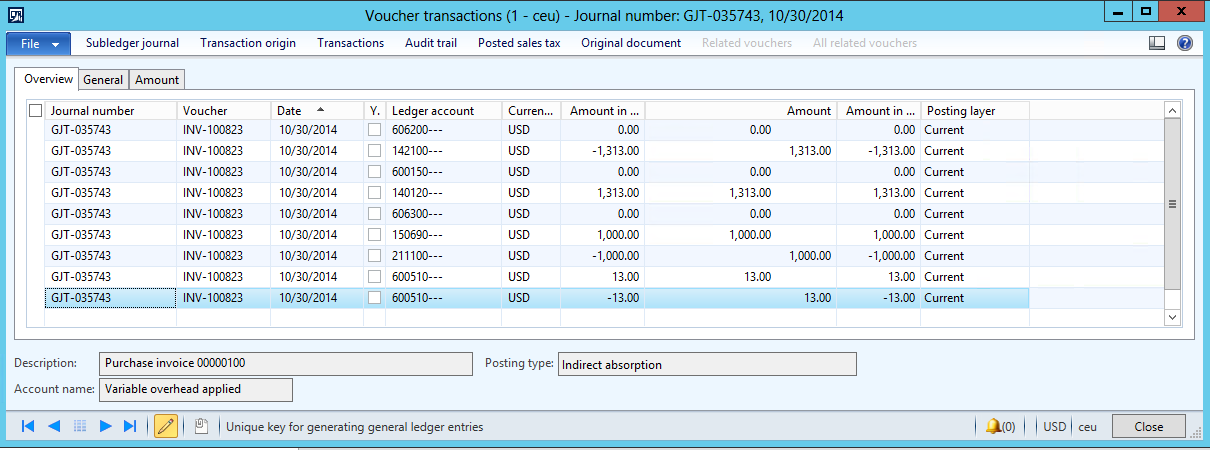

8. Post Invoice of all 10 pcs and validate postings

- The system will automatically reverse the Misc. charges postings done at time of

Product reciept. - The system will automatically apply the same Misc. charges codes at time of Invoice

- New calculations will be performed as the base

amount (Unit price) could have changed - Additional Misc. charges code can be added

- New calculations will be performed as the base

For simplicity in this example no change in unit price or additional Misc. charges are added

Voucher of Invoice

|

Account |

Name |

Direction |

Amount |

|

600510 |

Indirect cost absorption |

Credit |

0.00 |

|

142100 |

Inventory |

Debit |

0.00 |

|

150690 |

Purchase accrual |

Debit |

1000.00 |

|

600150 |

Auto Misc. charge absorption |

Credit |

0.00 |

|

606200 |

Misc. charge absorption |

Credit |

0.00 |

|

211100 |

Vendor Balance |

Credit |

1000.00 |

Note: You will see a few 0.00 postings in the voucher. These are related to a current limitation in posting engine and will be addressed at a later time. The postings are not effecting any balances in General ledger.

Inventory transactions after invoice

Released versions:

The feature will be made available for following releases of Microsoft Dynamics AX.

- Microsoft Dynamics AX 2012 R3

- Microsoft Dynamics AX 2012 R2 (This will beavailable at later time)