The Growing Power of Visualization – the next phase of markets

Too much information and too little time to absorb it - that's the dilemma of the financial markets today. We have more data than we can possibly absorb: spreadsheets with tens of columns and thousands of rows; news headlines streaming faster than the human eye can read.......

Yet the data tsunami continues to overwhelm us with almost every statistic imaginable.

So how can we process it all and see what information really counts?

Despite the takeover of markets by technology, human beings are still in charge of risk management and trading strategy and for this they need insight into how markets are moving.

Enter the next stage in the evolution of markets - data visualization.

Over the years there has been a huge sea change in the technology of computerized imaging. We have mastered the ability to turn massive amounts of 2D data into 3D information - from numbers into pictures and moving pictures at that. Visualization that used to require dedicated and expensive hardware is now possible on commodity-priced desktops.

A Microsoft partner, Aqumin (www.aqumin.com), is launching this technology in the financial services space. Their product Alpha Vision translates real-time market data into a dynamic panorama of the market place. Data that would normally require several trading screens to present can now be captured on a single screen lifting the fog of markets.

The co-founders of Aqumin originally developed this technology for the energy industry transforming massive seismic datasets, well logs and other related data into lucid, interpretable 3D images of hydrocarbon reservoirs in real time.

With Alpha Vision if you were following a sector you can now trade across a market or several markets. If you were trading say 25 bonds you can now trade 100 or more. If you are in charge of a dealing room you can pinpoint the position of each dealer as his portfolio changes. If you are a risk manager you can see your exposures in relation to your risk appetite moving as the markets move.

Even managing latency by client or counterparty is now a practical reality.

To the cynical this might seem like just another set of beautiful images. But the real purpose of visualization is insight not pictures and insight in financial markets carries a huge premium that can make a game-changing difference to financial performance.

Visual analytics leverages the fact that the brain is more attracted to and able to process dynamic images than millions of numbers. But the goal of information visualization is not simply to represent millions of bits of data as illustrations. It is to prompt instinctive comprehension, moments of insight that make viewers want to learn more.

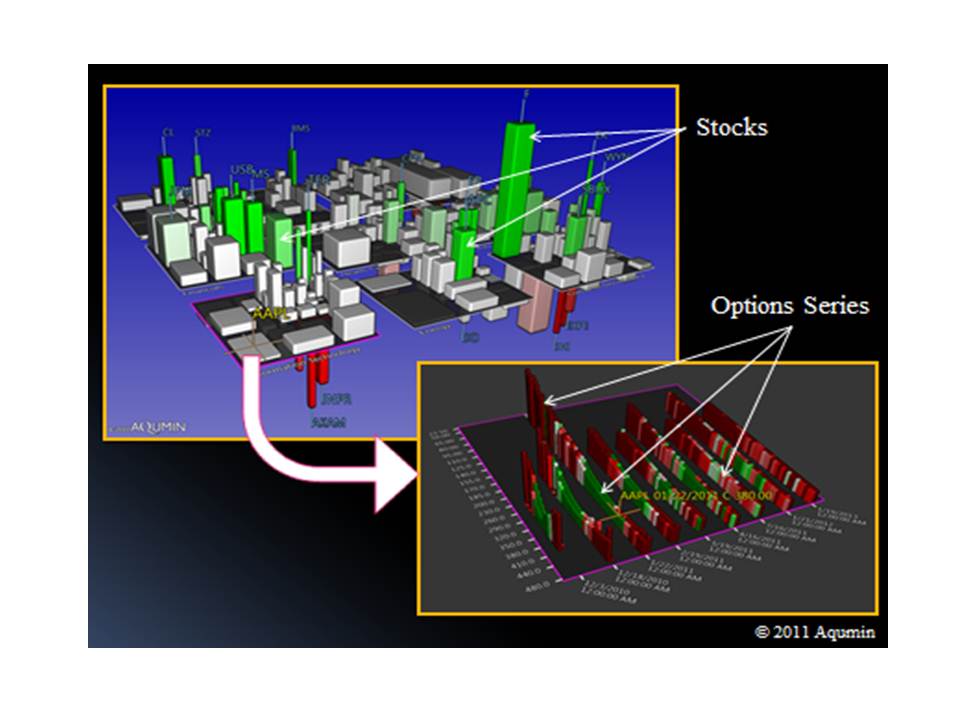

An example of Aqumin images showing the stock market and options details. The buildings represent stocks, their height and color market movements.

Alpha Vision represents data in terms of buildings and plates with the height of the buildings and their color providing critical insight into how markets are changing. Click on a building representing a security whose height and color signals a potential market opportunity and you can dive into the detail of that asset for more information.

We cannot afford to fly too high in a world of too much data. But thanks to the magic of data visualization technology, we can have instant access to on-the-ground information that enables us to manage financial markets more skillfully than before.

For a more detailed presentation of Alpha Vision please access the following URL:

https://www.aqumin.com/clientfiles/MSFTVignettesFinal5atg.pdf