Changing the standard VAT rate in Office Accounting 2008

Well, Gordon Brown has surprised us all by reducing the standard VAT rate for Christmas. Great news, but if you're a small business you may wondering just how you're going to implement it - or keep track of it!

Fortunately, if you're using Office Accounting 2008 it's quick and simple to change.

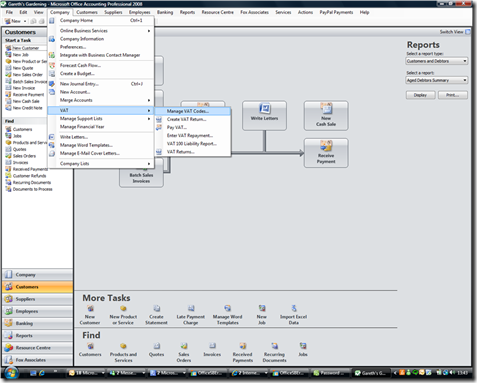

1) Select the ‘Company’ tab from the menu bar

2) Now scroll down and highlight ‘VAT’

3) Finally, with VAT still highlighted, select ‘Manage VAT Codes’ From the right hand menu

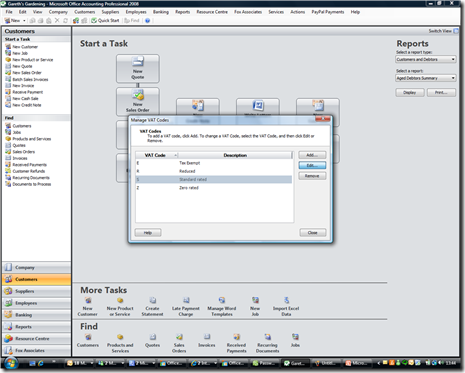

4) Now select ‘Standard rate’ and click the ‘edit’ button

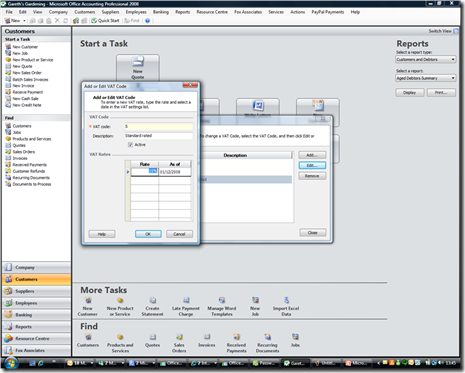

5) Highlight 17.5% and use your keyboard to change the rate to 15%

6) Change the date under ‘as of’ to 01/12/08, click the ‘OK’ button and Office Accounting is now ready to go with the correct standard rate of VAT.